- Mortgage Nuggets

- Posts

- Weekly mortgage demand plummets 10%

Weekly mortgage demand plummets 10%

Plus: New mortgage support program for struggling veterans set to become law

👋 Hi and welcome back to Mortgage Nuggets, your daily slice of mortgage news - always fresh, never stale. Today’s newsletter is 720 words, a 2.5-minute read.

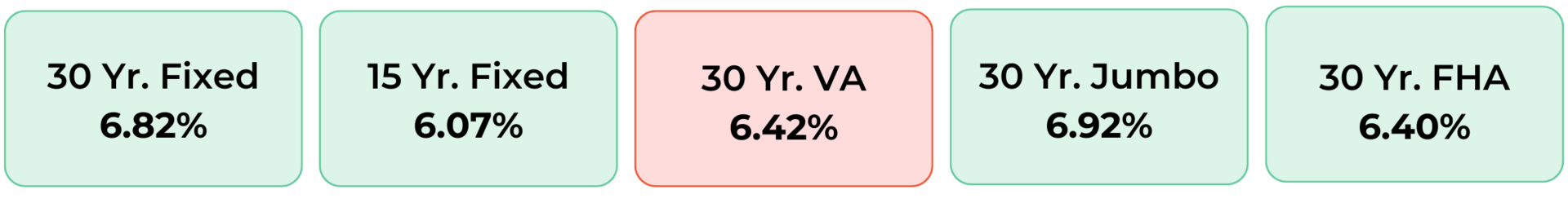

Disclaimer: Average mortgage rates as of July 17, 2025. © MND Daily Rate Index.

1. loanDepot hit with class-action lawsuit

Mortgage lender loanDepot is facing a class-action lawsuit in Maryland alleging it steered borrowers into higher-cost loans and manipulated internal documents to inflate profits ahead of its 2021 IPO.

The suit claims loanDepot violated federal loan officer compensation rules by pressuring LOs to push pricier loans or face reduced commissions or no pay. Plaintiffs say the company fabricated internal transfers to conceal these practices, including the robo-signing of signatures.

The alleged scheme affected borrowers in Maryland, Virginia, and Florida between 2019 and 2021 and could involve up to $300 billion in loan originations. The lawsuit cites violations of the Truth in Lending Act, wire fraud, securities fraud, and conspiracy.

2. New mortgage support program for struggling veterans set to become law

Senate lawmakers finalized plans Wednesday for a new home loan safety net program designed to prevent veterans from facing foreclosure, replacing a similar but controversial effort canceled by Veterans Affairs officials earlier this year.

The bill, known as the VA Home Loan Program Reform Act, had previously passed the House and now awaits President Donald Trump’s signature to become law. It would create a partial claim program for veterans who have fallen behind on housing payments, allowing them to defer a portion of what they owe on their mortgages.

“We are empowering VA to establish a partial claim program as an option of last-resort, which will preserve veteran homeownership and save taxpayer dollars by avoiding preventable foreclosures”

A MESSAGE FROM THE DAILY UPSIDE

Wall Street’s Morning Edge.

Investing isn’t about chasing headlines — it’s about clarity. In a world of hype and hot takes, The Daily Upside delivers real value: sharp, trustworthy insights on markets, business, and the economy, written by former bankers and seasoned financial journalists.

That’s why over 1 million investors — from Wall Street pros to Main Street portfolio managers — start their day with The Daily Upside.

Invest better. Read The Daily Upside.

3. More Nuggets

🏡 Why is the number of first-time homebuyers at a generational low? (theGuardian)

💸 What’s the average salary in the US? (The Hill)

🚨 Families, kids most at risk of losing HUD housing with Trump’s proposed time limits. (AP)

⚖️ NAR defeats discount brokerage Homie in antitrust lawsuit. (FloridaRealtors)

🏘️ Meet the mega broker recruiters who are dismantling retail strongholds. (NMP)

📊 NAR launches new tool to track key housing trends. (NAR)

4. Weekly mortgage demand plummets 10%

Renewed concerns over tariffs and the broader economy drove Treasury yields higher last week, and mortgage rates followed. As a result, total mortgage application volume dropped 10% last week compared with the previous week, according to the MBA’s seasonally adjusted index.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances, $806,500 or less, increased to 6.82% from 6.77%

Applications for a mortgage to purchase a home dropped 12% for the week and were 13% higher than the same week one year ago.

Applications to refinance a home loan dropped 7% for the week and were 25% higher than the same week one year ago.

“Treasury yields finished higher last week on average despite an intra-week drop, driven partly by renewed concerns of the impact of tariffs on the economy. As a result, mortgage rates rose after two weeks of declines, which contributed to slower application activity,” said Joel Kan, deputy chief economist at the MBA.

5. Zillow pushes back against Compass’s claims of conspiracy

Zillow formally opposed Compass’s bid for a preliminary injunction, insisting there is no legal duty to display Compass’s “hidden” listings on its platform. The response argues that antitrust laws do not force Zillow to deal with competitors on their preferred terms.

Detailing separate conversations with Redfin and eXp Realty, Zillow refutes claims of a coordinated conspiracy. The company states each partner independently endorsed its listing standards, and it plans to seek dismissal of the suit by August 22 if the injunction motion fails.

“Compass asks the Court to force Zillow to display Compass listings on Compass’s terms. But the antitrust laws do not permit Compass to force Zillow to deal with Compass on its preferred terms…” — Zillow court filing

QUICK POLL

Should Fannie Mae & Freddie Mac be taken public again? |

☀️ You’re all caught up. See you on Monday!

🚀 Wanna help our newsletter grow? Forward it to a friend or colleague.

Would you like to receive a ready-to-send weekly marketing email for your realtors and/or clients? Start your 30-day free trial here.

Was this email forwarded to you? Subscribe here.

Interested in advertising to 40k+ loan officers? Get in touch.