- Mortgage Nuggets

- Posts

- Trump says he wants to keep home prices high, lower borrowing costs

Trump says he wants to keep home prices high, lower borrowing costs

Plus: Former Sprout Mortgage CEO’s wife launches new company

☀️ Good morning. This is Mortgage Nuggets, the newsletter you lean on for fresh mortgage news. Today’s newsletter is 709 words, a 2.5-minute read.

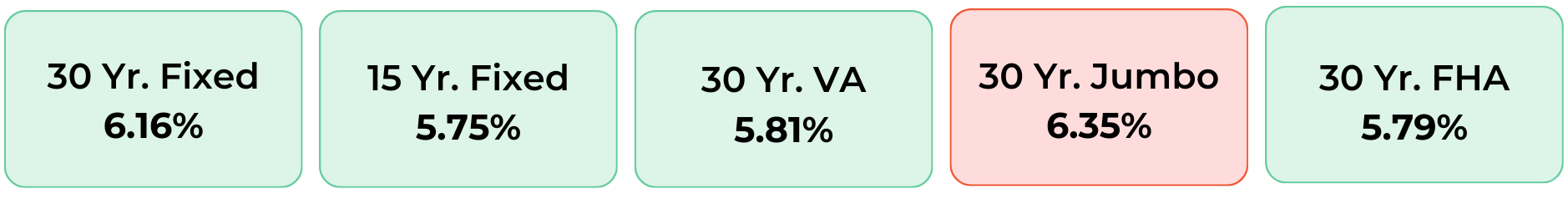

Disclaimer: Average mortgage rates as of January 30, 2026. © MND Daily Rate Index.

1. President Trump says he wants to keep home prices high, lower borrowing costs

President Trump said his administration will prioritize keeping home prices high while seeking to make homeownership more accessible, arguing that rising property values are a key source of household wealth and should not be undermined by affordability policies.

Speaking at a cabinet meeting, Trump said millions of homeowners have become “wealthy” because of higher home values and warned against measures that could push prices down. He said housing should not be made “too easy and too cheap” to buy if it risks eroding existing homeowners’ equity.

“I don’t want those values to come down,” Trump said in the meeting, referring to home prices. “We have millions of people that own houses and, for the first time in their life, they’re wealthy because the house is worth $500,000 or $600,000 or more or less, but more money than it’s ever been worth before. I don’t want to do anything to knock that down.”

2. Former Sprout Mortgage CEO’s wife launches new company

A new mortgage lender linked to the family of disgraced Sprout Mortgage founder Michael Strauss has emerged as Sprout’s bankruptcy and wage cases continue to stall.

Public records show Elizabeth Strauss, Michael Strauss’ wife, founded Investor Funding Corp. in Irvine, California in 2024, alongside a former Sprout executive.

The company is licensed in four states, employs three people and includes Vinh Nguyen Luu, who previously served as Sprout’s senior vice president of servicing, according to NMLS filings. There is no public evidence Michael Strauss is formally involved.

Marketing That Pays Monthly.

I built a marketing email that gets me one deal a month from agents I’ve never even met. No calls. No chasing. Just results.

⚙️ Want to plug into something that works?

🧠 Let the email do the networking for you.

👉 [Start sending smarter emails now.] Try it for free for 30 days!

— Dave Krichmar CEO

3. More Nuggets

🗑️ Why American cities pay over $3,000 for one trash can. (theHustle)

🗞️ New Epstein documents detail Alexander brothers rape allegations. (RealDeal)

🏢 HUD orders citizenship verification for 200,000 tenants. (IndustryDive)

👋 Dan Sogorka steps down as Rocket Pro GM; Austin Niemiec takes over. (NMP)

4. More than 40,000 signed home purchase agreements were canceled in December

Serious headwinds in the housing market and the broader economy are tanking home sales at an alarming rate.

More than 40,000 signed home purchase agreements were canceled in December, representing 16.3% of all homes that went under contract, according to Redfin, a real estate brokerage. That’s up from 14.9% in December 2024.

“High housing costs and rising inventory have made homebuyers more selective,” said Chen Zhao, head of economics research at Redfin. “Home sellers outnumber buyers by a record margin, meaning the buyers who are in the market have options and may walk away if they believe they can find a better or more affordable home.”

5. Judge denies broker’s bid to force NAR, MLSs to enforce their own rules

A Florida federal judge denied a flat-fee broker’s request to force the National Association of Realtors and multiple MLSs to enforce their own rules, blocking an early attempt to challenge industry practices tied to commissions and listing visibility.

U.S. District Judge William Dimitrouleas rejected a preliminary injunction sought by Jorge Zea, owner of SnapFlatFee.com, after Zea failed to object on time to a magistrate judge’s recommendation.

Zea alleges NAR, 16 local Realtor associations and MLSs coordinated to protect traditional commission structures by not enforcing rules designed to prevent steering and ensure equal treatment of listings. He claims buyer agents steer clients away from homes offering reduced or no buyer-agent commissions, harming his flat-fee brokerage model.

☀️ You’re all caught up. See you on Wednesday!

🚀 Wanna help our newsletter grow? Forward it to a friend or colleague.

Would you like to receive a ready-to-send weekly marketing email for your realtors and/or clients? Start your 30-day free trial here.

Was this email forwarded to you? Subscribe here.

Interested in advertising to 40k+ loan officers? Get in touch.