- Mortgage Nuggets

- Posts

- Starter-home sales continue upward trend

Starter-home sales continue upward trend

Plus: GAO investigating Pulte after Trump rivals targeted

🗓️ Good morning! The weekend is here. Today’s newsletter is 746 words, 3 minutes.

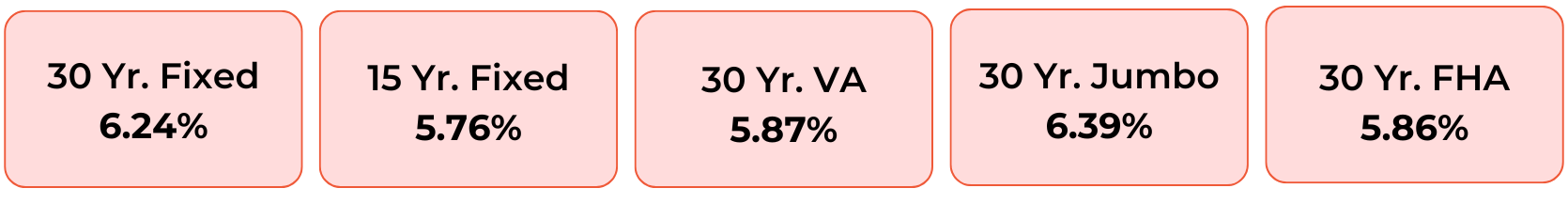

Disclaimer: Average mortgage rates as of December 04, 2025. © MND Daily Rate Index.

1. GAO investigating Pulte after Trump rivals targeted

The Government Accountability Office (GAO) on Thursday confirmed it has launched an investigation into Federal Housing Finance Agency (FHFA) Director Bill Pulte, who has opened numerous probes into the mortgage dealings of adversaries of President Trump.

Pulte has referred at least four different Democrats to the Justice Department for prosecution, recommending charges for Sen. Adam Schiff and Rep. Eric Swalwell, both Democrats from California, while prosecutors have brought mortgage-related charges against New York Attorney General Letitia James (D) and Federal Reserve board of governors member Lisa Cook.

Senate Democrats last month had asked the nonpartisan watchdog for an investigation, and GAO said Thursday it took the case based on a referral.

“GAO has accepted this request following our standard process,” the agency said in a statement. “The first thing GAO does as any work begins is to determine the full scope of what we will cover and the methodology to be used.”

2. Towne Mortgage hit with seven lawsuits after data breach

Towne Mortgage is facing seven class-action lawsuits after disclosing a June data breach that exposed Social Security numbers and financial account information.

The lender hasn’t said how many customers were affected, though a filing indicates at least 474 residents in Massachusetts were hit. Cybercrime group Blackbyte has claimed responsibility.

The suits, filed in federal court in Michigan, accuse the company of negligence and seek damages and stronger data-security measures. The case is expected to follow the pattern of other mortgage-sector breaches, which have led to years of litigation and, in some instances, large settlements.

Your Pricing Is Holding You Back

Tired of cringing at your rates? At Canopy Mortgage, you get pricing like a broker with the control of a correspondent banker. Our transparent platform lets you set your own margins, so you can stop losing deals to high rates.

Curious how that works? See how other LO’s have gained full control over their business and started winning.

3. More Nuggets

📉 Mortgage rates finally moved lower last week, but that didn’t do much for demand. (CNBC)

💸 AD Mortgage opens $417M securitization to investors. (HousingWire)

📊 Senate Democrats warn CFPB shutdown could disrupt prime interest rates. (Yahoo)

📰 Fannie Mae, Freddie Mac limit public housing data releases. (HousingWire)

4. Freddie Mac: Mortgage rates move lower

Mortgage rates fell for a second straight week, though the decline may not last given the recent rise in the 10-year Treasury yield ahead of next week’s Fed meeting.

Freddie Mac said the average 30-year fixed mortgage rate slipped to 6.19% for the week of Dec. 4, down from 6.23% a week earlier and from 6.69% a year ago. The 15-year fixed rate dropped to 5.44% from 5.51%. Both are roughly half a percentage point lower than this time last year.

"Mortgage rates decreased for the second straight week as we emerged from the Thanksgiving holiday," said Sam Khater, Freddie Mac's chief economist in a press release. "Compared to this time last year, mortgage rates are half a percent lower, creating a more favorable environment for homebuyers and homeowners."

A MESSAGE FROM MORTGAGE NUGGETS

Marketing email review:

I am loving the consistency. I’ve been trying to do this myself for years because I like to write, but I just never keep up with it. You can definitely roll my free trial into a subscription. Thanks Mortgage Nuggets!!

5. Starter-home sales continue upward trend

Starter-home sales rose 4.9% year-over-year in October, marking the 14th straight monthly gain and outpacing mid- and high-tier segments, according to Redfin.

Buyers are concentrating on the lowest-priced homes as affordability pressures persist. Pending sales in the starter tier climbed 5.5%, compared with 1.1% growth in both mid- and high-priced categories.

Starter-home prices increased 2% to $260,000, the second-slowest pace in a decade, as inventory in this segment rose 13% to its highest October level since 2016.

“Conditions are improving, with more listings and steadier prices, but many buyers are only turning to this tier because they have been priced out of higher tiers. That means sales at the low end of the market are relatively strong, but it also means that first-time buyers may find themselves competing with move-up or move-down buyers.” Chen Zhao, head of economic research at Redfin

☀️ You’re all caught up. See you on Monday!

🚀 Wanna help our newsletter grow? Forward it to a friend or colleague.

Would you like to receive a ready-to-send weekly marketing email for your realtors and/or clients? Start your 30-day free trial here.

Was this email forwarded to you? Subscribe here.

Interested in advertising to 40k+ loan officers? Get in touch.