- Mortgage Nuggets

- Posts

- Rice Park Capital acquires Rosegate Mortgage

Rice Park Capital acquires Rosegate Mortgage

Plus: 45% of Americans would consider a 50-yr mortgage

It's Monday. Thanks for joining us. Today’s newsletter is 511 words, a 2-minute read.

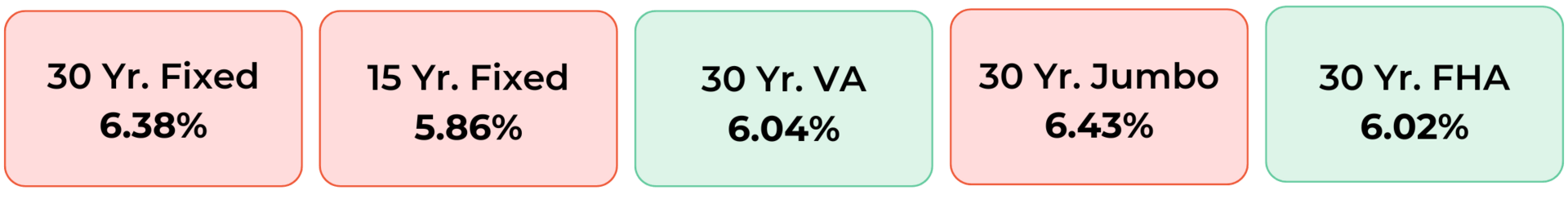

Disclaimer: Average mortgage rates as of November 14, 2025. © MND Daily Rate Index.

1. Rice Park Capital acquires Rosegate Mortgage

Rice Park Capital bought Rosegate Mortgage to integrate loan origination with its mortgage-servicing-rights strategy.

The acquisition gives Rice Park an in-house channel to run recapture on MSR holdings when no prior recapture agreement exists, while keeping existing partner agreements intact.

Rosegate will operate with Nexus Nova inside Rice Park but retain its branding. Rosegate plans to expand retail and consumer-direct lending. Rice Park’s MSR portfolio is about $61 billion; Rosegate has originated about $117 million this year.

2. 45% of Americans would consider a 50-yr mortgage

A BadCredit.org survey shows strong age, gender, and political divides over 50-year mortgages. Millennials are most receptive, while Boomers are wary. Republicans show higher support than Democrats and Independents, and men are more open than women. Here are the key takeaways from the survey:

Millennials are the most open to a 50-year mortgage, with more than half (54%) saying they’d consider it, compared to just 29% of Boomers, who overwhelmingly reject the idea.

Republicans (54%) are far more supportive of 50-year loans than Democrats or Independents (both 41%), highlighting a partisan divide over how to make housing payments more affordable.

Men (52%) are more inclined than women (39%) to take on ultra-long mortgages, revealing a gender divide in financial optimism and risk-taking.

Give the Gift of Homeownership, Get the Advantage of a Lifetime

What if you could give your clients a homeownership portal that helps them save thousands and build real wealth? Now you can.

OneHomeowner is a homeowner engagement tool, designed to help them manage their home, track their equity, and make smarter financial decisions. When you become a trusted resource for vital information, you'll stay top-of-mind and get a powerful competitive edge.

Plus, in an environment where interest rates are dropping, you'll receive real-time alerts when clients are ready to refinance, giving you the inside track on new business.

Ready to see how you can become an indispensable resource for your clients? Schedule a demo today.

3. More Nuggets

📊 Mortgage fraud risk rises by 8.2% as prices drop. (Cotality)

💼 CFPB's funding nearly exhausted. (NMP)

🆕 RealPage names former exec as new CEO. (MultifamilyDive)

💤 ION: The woman who puts America to sleep. (theHustle)

4. Fair housing complaints rise amid HUD staffing cuts

Fair-housing complaints surged to 32,321 in 2024, one of the highest totals in two decades, according to the National Fair Housing Alliance. Disability-related cases made up more than half.

Local fair-housing groups, responsible for most filings, have been hit by funding losses, forcing multiple closures and cutting off protections for disabled veterans, seniors, families with children, domestic-violence survivors, and Black and Latino buyers.

The report lands amid steep staffing reductions at HUD. Its civil-rights office now has roughly one-third of the personnel it had at the start of the Trump administration, with more than 400 additional layoffs during the shutdown. Enforcement activity has also weakened.

☀️ You’re all caught up. See you on Wednesday!

🚀 Wanna help our newsletter grow? Forward it to a friend or colleague.

Would you like to receive a ready-to-send weekly marketing email for your realtors and/or clients? Start your 30-day free trial here.

Was this email forwarded to you? Subscribe here.

Interested in advertising to 40k+ loan officers? Get in touch.