- Mortgage Nuggets

- Posts

- Refinance demand jumps 14%

Refinance demand jumps 14%

Plus: Broker granted $24K after buyer breaks contract

🌅 Wednesday, and two weeks 'til Christmas! (No gifts, please, we're just happy you're here). Today’s newsletter is 570 words, a 2.5-minute read. let’s dive in…

Disclaimer: Average mortgage rates as of December 09, 2025. © MND Daily Rate Index.

1. Refinance demand jumps 14%

Applications to refinance a home loan rose 14% last week compared with the previous week. The refinance share of mortgage activity increased to 58.2% of total applications from 53.0% the previous week.

Applications for a mortgage to purchase a home dropped 2% for the week and were 19% higher than the same week one year ago. The average rate for 30-year fixed-rate mortgages increased to 6.33% from 6.32%.

“Conventional purchase applications were down for the week, but there was a 5 percent increase in FHA purchase applications as prospective homebuyers continue to seek lower downpayment loans,” said Joel Kan, an MBA economist.

2. Broker granted $24K after buyer breaks contract

A Florida arbitrator ordered a homebuyer to pay Echo Fine Properties $24,000 after finding he breached an exclusive buyer broker agreement by purchasing an $800,000 home through another brokerage.

The award represents the 3% commission Echo was entitled to under the signed contract. Echo discovered the breach when a mortgage broker flagged that the buyer, known to be working with Echo, had submitted an offer with a different buyer’s agent.

After Echo warned him he was still under contract, the buyer ignored the notice and later amended the agreement twice, briefly substituting his mother’s name for his own. The arbitrator ruled the agreement was clear and enforceable, rejecting the buyer’s claims that he hadn’t read it and that Echo’s agent provided little value.

Attention Loan Officers!

Guideline Buddy just made a big move. We now include Newfi’s underwriting guidelines which means instant answers for Non-QM loans are live and ready.

While other LOs are flipping pages, you’re pulling up solutions in seconds.

Give yourself the edge.

P.S. Non-QM just got a whole lot easier.

3. More Nuggets

🪓 ROAD to Housing Act cut from defense bill. (Scotsman Guide)

💼 CrossCountry seeks $2.1 million from LO accused of fraud. (HousingWire)

🤝 Corcoran Sawyer Smith acquires Liberty Realty. (ROI-NJ)

💸 You’re probably $30,000 short of what you need to buy a house—and you’re not alone. (smry)

🔔 And the Oxford Word of the Year 2025 is…‘Rage bait’ (Oxford)

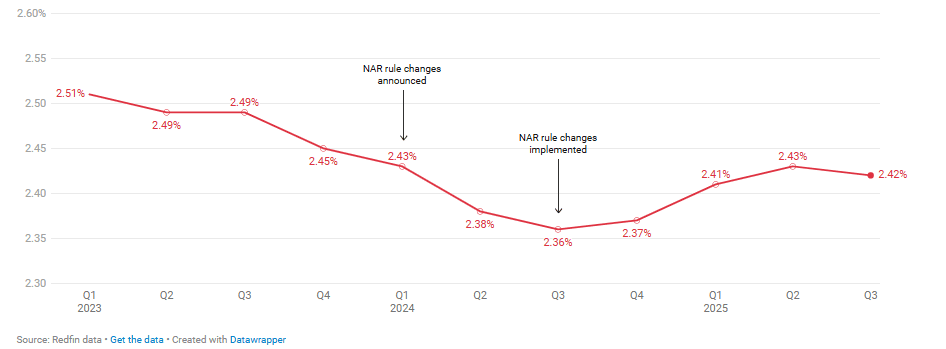

4. Buyer's agent commissions are slightly higher following new NAR rules

Average commission paid to U.S. real estate agents representing buyers

The average U.S. buyer’s agent commission was 2.42% for homes sold in the third quarter, up from 2.36% when the new NAR rules went into effect in August 2024. That’s according to Redfin’s latest report. Homes under $500,000 carry the highest commissions at 2.52%.

5. Evolve data breach lawsuit

Evolve Mortgage Services was hit with a proposed class action in Texas federal court alleging a ransomware gang stole more than 20 terabytes of sensitive data the company has never publicly disclosed.

Former employee Rebekah Hardy accuses the mortgage technology vendor of lax cybersecurity that allegedly allowed INC Ransom to access data dating back to 2016, including Social Security numbers, ID scans and full credit histories of employees and clients.

Evolve has largely denied wrongdoing in court filings and says it lacks sufficient information to confirm the attack, while the case is still at an early stage with no hearings or deadlines set.

ONE TWEET

☀️ You’re all caught up. See you on Friday!

🚀 Wanna help our newsletter grow? Forward it to a friend or colleague.

Would you like to receive a ready-to-send weekly marketing email for your realtors and/or clients? Start your 30-day free trial here.

Was this email forwarded to you? Subscribe here.

Interested in advertising to 40k+ loan officers? Get in touch.