- Mortgage Nuggets

- Posts

- Pending home sales show slight annual gain in July

Pending home sales show slight annual gain in July

Plus: Rocket, Mr. Cooper merger OK'd by the FHFA

🌴 Finally Friday! Today’s newsletter is 599 words, 2.5-minute read. We will be off on Monday for Labor Day, and back in your inbox on Tuesday morning.

Disclaimer: Average mortgage rates as of August 28, 2025. © MND Daily Rate Index.

1. Pending home sales show slight annual gain in July

Pending home sales edged down in July 2025, signaling continued buyer caution despite modest improvements in mortgage rates and inventory, according to the NAR. Contracts for existing homes fell 0.4% from June but were 0.7% higher than a year earlier.

The data reveal divergent trends across the country. Sales in the Northeast and Midwest slipped from the previous month, while the South held steady and the West saw a gain. On a year-over-year basis, the Northeast and West registered declines, contrasted by increases in the Midwest and South.

"The housing market remains in a delicate balance," said Lawrence Yun, NAR's Chief Economist. "Even with mortgage rates easing slightly, buyers remain deliberate. Purchasing a home is often the largest financial decision of their lives, so many take their time to make sure both timing and property fit their needs."

2. Rocket, Mr. Cooper merger OK'd by the FHFA

The Federal Housing Finance Agency (FHFA) cleared the path this week for Rocket Companies’ $9.4 billion acquisition of Mr. Cooper Group, imposing strict market concentration limits to safeguard the nation’s mortgage system.

The agency authorized Fannie Mae and Freddie Mac to approve the deal between two of their largest seller-servicer counterparties, subject to conditions ensuring safety and soundness. Most notably, regulators capped each company’s servicing market share at 20% of Fannie Mae and Freddie Mac’s portfolios.

“No market participant should have greater than 20% of Fannie or Freddie’s servicing market in order to ensure the safety and soundness of the mortgage market and the overall economy,” the FHFA stated in its announcement.

🚨 Coach’s Corner

It is going old school! Social media is important but some old-school tactics are going to be the key in this market. Tune in for my breakdown!

— Dave Krichmar CEO

3. More Nuggets

⚖️ Fed’s Cook sues Trump over attempted firing. (BankingDive)

🆗 Mortgage fraud surged in Q2, led by multifamily, investment fraud. (MPA)

🏘️ More money for less square footage. (NMP)

📊 Homebuyers have been retreating. Now sellers are too. (Redfin)

A MESSAGE FROM 1440

Daily News for Curious Minds

Be the smartest person in the room by reading 1440! Dive into 1440, where 4 million Americans find their daily, fact-based news fix. We navigate through 100+ sources to deliver a comprehensive roundup from every corner of the internet – politics, global events, business, and culture, all in a quick, 5-minute newsletter. It's completely free and devoid of bias or political influence, ensuring you get the facts straight. Subscribe to 1440 today.

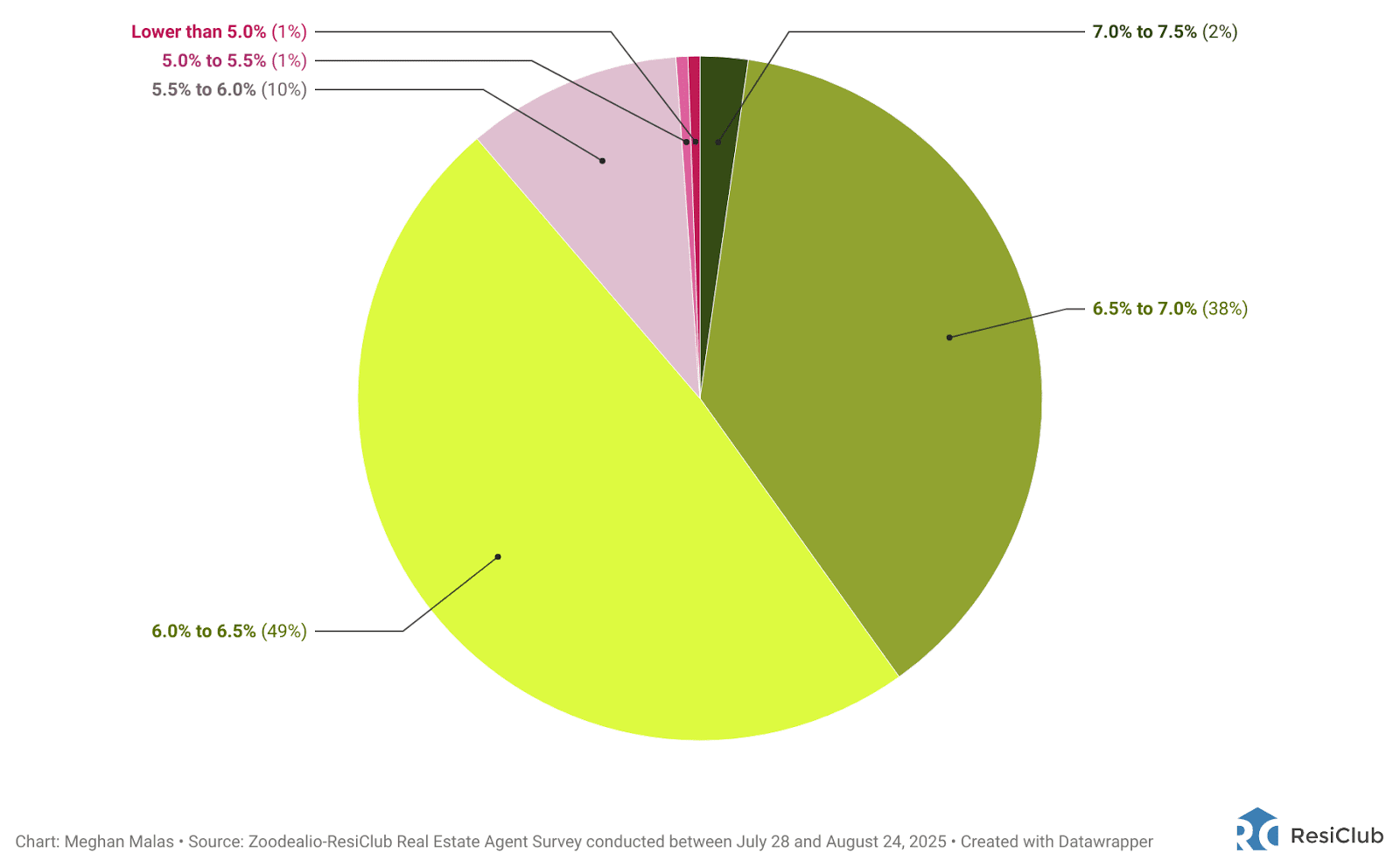

4. Charted: Where real estate agents expect the average 30-year fixed mortgage rate to be at the end of 2025

Source: ResiClub

5. JPMorgan Chase relaunches HELOC loans

Chase Home Lending is once again offering a home equity line of credit, five years after hitting pause on the product early in the COVID-19 pandemic.

The bank is looking to capitalize on record-high home values, according to Digital Channel Executive Erik Schmitt. By contrast, in 2020, it was reacting to market uncertainty, alongside peers Wells Fargo and Bank of America.

Wells “temporarily” stopped offering them and has yet to resume the business, and Bank of America continued to offer HELOCs, but tightened its credit standards.

“As home valuations reach historic highs, homeowners are looking for more options to tap into their home’s equity. We’re proud to offer customers the ability to secure a HELOC through Chase,” Schmitt said in a prepared statement Monday.

💭 BRAIN TEASER

💭 How much did I earn in total? |

☀️ You’re all caught up. See you on Tuesday!

🚀 Wanna help our newsletter grow? Forward it to a friend or colleague.

Would you like to receive a ready-to-send weekly marketing email for your realtors and/or clients? Start your 30-day free trial here.

Was this email forwarded to you? Subscribe here.

Interested in advertising to 40k+ loan officers? Get in touch.