- Mortgage Nuggets

- Posts

- Pending home sales rise 1.9% in October

Pending home sales rise 1.9% in October

Plus: FHFA raises 2026 conforming loan limit to $832,750

🌅 Good morning, Wednesday! Today’s newsletter is 772 words, a 3.5-minute read.

Programming note: We will be off tomorrow and Friday, as we hope you will be, for the Thanksgiving holiday. We'll be back with you Monday!

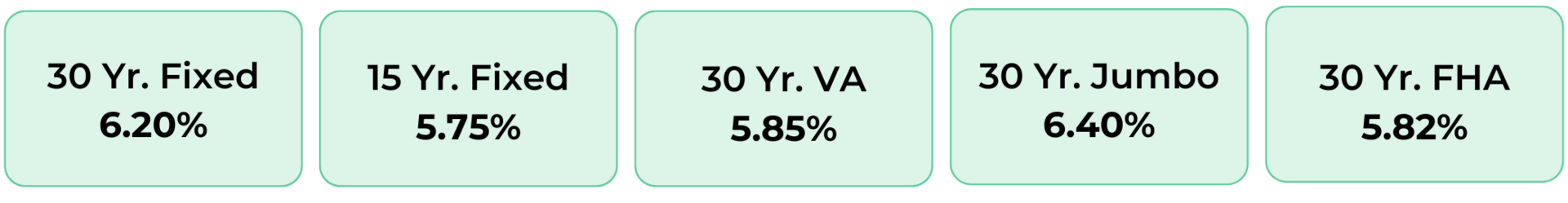

Disclaimer: Average mortgage rates as of November 26, 2025. © MND Daily Rate Index.

1. FHFA raises 2026 conforming loan limit to $832,750

The Federal Housing Finance Agency (FHFA) today announced that the baseline conforming loan limit for mortgages acquired by Fannie Mae and Freddie Mac in 2026 will rise to $832,750, an increase of $26,250 from 2025.

The conforming loan limits are required by law to reflect the percentage change in the average U.S. home price during the most recent 12-month or four-quarter period ending before the time of determining the annual adjustment.

In 2026, the conforming loan limit will rise 3.26% because FHFA has determined that the average U.S. home value increased by that amount between the third quarters of 2024 and 2025.

Higher loan limits will be in effect in higher-cost areas as well. The new ceiling loan limit in high-cost markets will be $1,249,125, which is 150% of $832,750. The previous ceiling was $1,209,750.

2. Pending home sales rise 1.9% in October

Pending sales of previously owned US homes rose in October by more than forecast as buyers took advantage of a decline in mortgage rates.

An index of contract signings increased 1.9% to 76.3, the highest in nearly a year, according to data issued Tuesday by the National Association of Realtors.

A decline in mortgage rates to a one-year low during the month, along with a pickup in inventory this year, helped encourage potential buyers to step off the sidelines.

“Pending home sales ticked up in October from September, another sign that easing mortgage rates and slightly improved affordability are coaxing more buyers back into the market,” Odeta Kushi, the deputy chief economist at First American, said in a statement.

A MESSAGE FROM MORTGAGE NUGGETS

“The last Mortgage Nugget marketing email got me 5 conversations with realtors I hadn't work with. That email cost less than a coffee meeting and way more effective. Love it!! - Happy Loan Officer

3. More Nuggets

🏡 Zillow forecast for metro-level home price change between October 2025 and October 2026. (ResiClub)

💼 Witness exposes unusual tactics used to prop up mortgage fraud cases. (WPost)

💸 More than half of U.S. homes have dropped in value over the last year — and nearly all houses in these cities have seen losses. (Fortune)

💻 Zillow launches new tool to help renters build credit. (Zillow)

ION: Gmail clone, except you're logged in as Epstein and can see his emails. (X)

4. Loan profits improve for IMBs in Q3 2025

The MBA reports that independent mortgage banks (IMBs) and mortgage subsidiaries of chartered banks posted a pre-tax net production profit of $1,201 per loan in Q3 2025, up from $950 per loan in Q2.

“After several years of uneven performance, mortgage companies saw improved financial results in the third quarter,” said Marina Walsh, MBA’s vice president of industry analysis. “Across production and servicing, about 85% of the more than 325 companies we surveyed were profitable.”

Walsh noted a strong uptick in loan applications that locked in September and flowed into Q3 earnings. After accounting for fallout, many of those locks are expected to convert to closed loans in Q4, alongside related mark-to-market revenue impacts.

5. RealPage settles rent price-fixing suit with DOJ

The DOJ and RealPage reached an agreement Monday to settle a 2024 lawsuit that claimed the software provider enabled landlords to collude to raise rent prices beyond free market levels.

The settlement, filed in the U.S. District Court for the Middle District of North Carolina, is subject to court approval. The agreement includes no financial penalties, damages or findings or admissions of wrongdoing, but puts guardrails around what data RealPage can collect and how it can use it.

“This resolution with the DOJ was necessary to provide certainty and finality for RealPage and its customers to avoid protracted litigation,” said Stephen Weissman, Gibson Dunn partner and former deputy director for the Federal Trade Commission, in a Monday press release from RealPage.

A MESSAGE FROM MORTGAGE NUGGETS

“The last Mortgage Nugget marketing email got me 5 conversations with realtors I hadn't work with. That email cost less than a coffee meeting and way more effective. Love it!! - Happy Loan Officer

☀️ You’re all caught up. See you on Monday!

🚀 Wanna help our newsletter grow? Forward it to a friend or colleague.

Would you like to receive a ready-to-send weekly marketing email for your realtors and/or clients? Start your 30-day free trial here.

Was this email forwarded to you? Subscribe here.

Interested in advertising to 40k+ loan officers? Get in touch.