- Mortgage Nuggets

- Posts

- New foreclosures jump 20% in October

New foreclosures jump 20% in October

Plus: Affordability woes mean discounts for investors

👋 Welcome back to Mortgage Nuggets! We scour 100+ sources so you don’t have to. Today's newsletter is 729 words, a 3-minute read, let’s dive in…

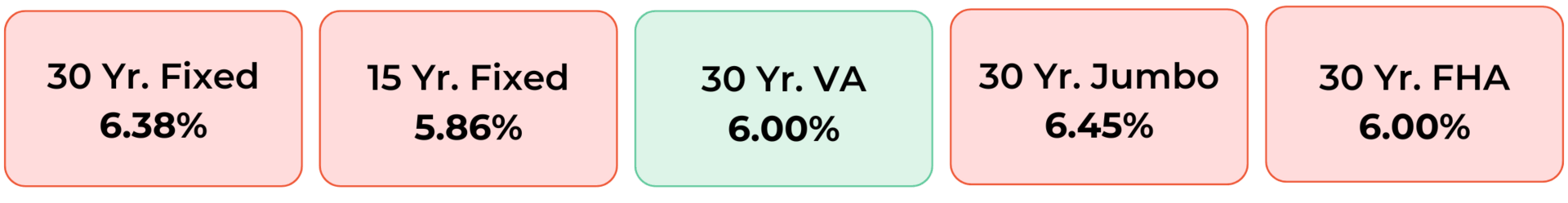

Disclaimer: Average mortgage rates as of November 18, 2025. © MND Daily Rate Index.

1. Mortgage rates hit highest level in a month, pushing loan demand down 5.2%

Mortgage rates rose for the third consecutive week, causing demand from both current homeowners and potential homebuyers to drop. Total mortgage application volume fell 5.2% last week compared with the previous week, according to the MBA..

The average contract interest rate for 30-year fixed-rate mortgages increased last week to 6.37% from 6.34%. That is the highest level in four weeks.

Applications to refinance a home loan, which are most sensitive to short-term moves in rates, fell 7% for the week but were still 125% higher than the same week one year ago.

Applications for a mortgage to purchase a home fell 2% for the week and were 26% higher than the same week one year ago.

“Application activity over the week was lower, with potential homebuyers moving to the sidelines again, although there was a small increase in FHA purchase applications,” noted Joel Kan, an MBA analyst.

2. New foreclosures jump 20% in October

In October, foreclosure activity rose again – up 3% from September and 19% year-over-year – as one in every 3,871 housing units received a notice, for a total of 36,766 filings.

Foreclosure starts were up 20% year-over-year, and repossessions were up 32% YoY. Overall, the data points to continued upward pressure in select markets despite foreclosure activity remaining below historic norms.

Here are the top 10 states with the highest foreclosure rates:

|

|

Attention Loan Officers!

Guideline Buddy just made a big move. We now include Newfi’s underwriting guidelines which means instant answers for Non-QM loans are live and ready.

While other LOs are flipping pages, you’re pulling up solutions in seconds.

P.S. Non-QM just got a whole lot easier.

3. More Nuggets

💼 Trump: ‘People are holding me back’ from firing Jerome Powell. (The Hill)

📊 2026 could finally be the year home sales rebound. (RealEstateNews)

🏘️ Don't merge Fannie and Freddie, says their biggest investor. (inman)

⏸️ Transparency? Not today. NAR delegates reject referral-fee disclosure rule. (HW)

4. Affordability woes mean discounts for investors

Cotality reports that investor purchases climbed from 29% in June 2025 to 30% in September 2025, signaling renewed momentum in the home investor market.

According to the Cotality Investor Purchase Indicator, strained affordability has reduced competition from traditional buyers, expanded inventory options, increased seller flexibility, and strengthened rental demand; conditions that investors are actively taking advantage of.

“As sellers find it harder to sell at the price they want, inventory is accumulating and investors are taking advantage of the opportunity for discounts. Some sellers may choose to become landlords, but others might decide to take a small price cut and sell to an investor” said Thom Malone, principal economist at Cotality.

5. Freddie Mac launches new quality control platform

Freddie Mac has introduced a consolidated quality-control system, Quality Control Advisor Plus, intended to accelerate and standardize post-delivery loan reviews for single-family mortgages.

The platform merges previously separate QC tools and automates defect detection, document checks, and remediation tracking. Freddie Mac states the system will shorten review timelines by months and reduce repurchase exposure for lenders. It also delivers real-time alerts for issues such as missing documentation, provides early-origination feedback, supports bulk file uploads, and centralizes status reporting.

The rollout is phased through 2025, with 500 lenders already participating in a pilot tied to repurchase-alternative options. Data from that group shows a 26 percent lower rate of nonacceptable loan quality compared with nonparticipants, translating into reduced buyback costs.

☀️ You’re all caught up. See you on Friday!

🚀 Wanna help our newsletter grow? Forward it to a friend or colleague.

Would you like to receive a ready-to-send weekly marketing email for your realtors and/or clients? Start your 30-day free trial here.

Was this email forwarded to you? Subscribe here.

Interested in advertising to 40k+ loan officers? Get in touch.