- Mortgage Nuggets

- Posts

- Mortgage refinancing rose again, but rates are now moving higher

Mortgage refinancing rose again, but rates are now moving higher

Plus: Balance Homes relaunches with $30M investment

🧷 Strap in! Today’s edition is 722 words, 3.5 minutes.

🗳️ Invite your friends to get the newsletter here.

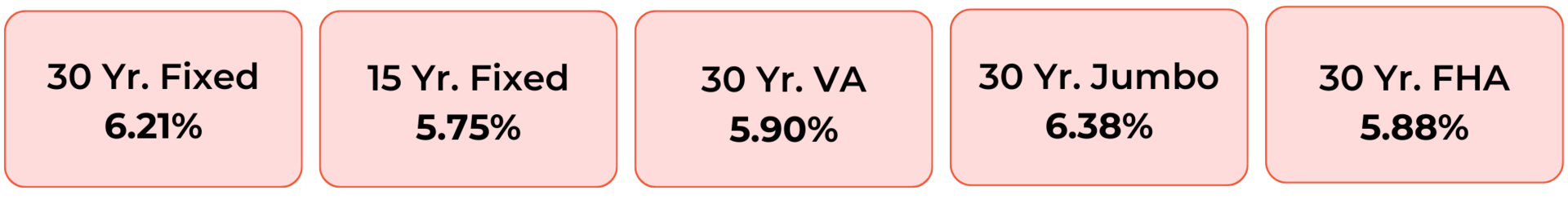

Disclaimer: Average mortgage rates as of January 20, 2026. © MND Daily Rate Index.

1. Mortgage refinancing rose again, but rates are now moving higher

According to the MBA, mortgage refinancing jumped sharply higher for the second straight week, as interest rates fell further, but that boom may be about to bust. Interest rates are now moving much higher.

Applications to refinance a home loan rose 20% compared with the previous week. They were 183% higher than the same week one year ago.

Applications for a mortgage to purchase a home rose 5% for the week and were 18% higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages decreased to 6.16% from 6.18%.

“Mortgage rates declined further last week, driving another big week for refinance applications, which saw the strongest level of activity since September 2025,” said Joel Kan, MBA’s vice president and deputy chief economist.

2. Trump signs executive order barring Wall Street investors from buying single-family homes

On January 7, Trump said he would immediately take steps to ban large institutional investors from buying more single-family homes and would ask Congress to codify it. On January 20, 2025, he signed an order that sets up a preliminary version of that “ban” and signals the White House will pursue legislation.

The order gives Treasury 30 days to define “large institutional investors.” It then gives multiple agencies 60 days to issue guidance limiting how the federal government facilitates institutional purchases of single-family homes that could otherwise go to owner-occupants. Within that same window, VA/FHA and Fannie Mae/Freddie Mac would be barred from approving, insuring, guaranteeing, or securitizing single-family-home purchases by those investors.

So it doesn’t ban institutional homebuying or force landlords to sell existing holdings. It targets their access to federally backed financing and other government support for new single-family-home acquisitions. It also includes an exception for build-to-rent communities.

Is Your P&L Paying for Bloated Middle Management?

While legacy lenders are adding layers, fees, and margin pads to cover their overhead, Canopy Mortgage stripped the fat AND they built a proprietary tech stack that creates a massive reduction in the cost-to-produce.

The result? You aren't subsidizing regional managers who don't know your name. Instead, you get:

Broker-competitive pricing.

Direct access to decision-makers.

A significantly higher comp plan.

Stop paying for the past. See the future of lending here.

3. More Nuggets

📈 Mortgage rates jump to match highest levels in nearly a month. (MND)

😏 Work hard, play hard — at the same time. (Axios)

🏡 Homebuilder sentiment comes in lower than expected in January. (CNBC)

💼 One Real Mortgage hires Kate Gurevich as CEO. (LinkedIn)

🤝 Partial settlement reached in eXp sexual assault lawsuit. (NSC)

4. Washington agent sues Zillow for alleged mortgage steering

A Washington state real estate agent filed a proposed class action in federal court in Seattle on Jan. 16, 2026, alleging Zillow used its lead programs to pressure agents and buyers to route mortgages through Zillow Home Loans.

The suit follows earlier steering/kickback allegations in the same court that claim agents were rewarded with better leads only if they met internal “conversion” expectations for Zillow Home Loans, with plaintiffs citing RESPA and Washington consumer-protection law; related cases have been consolidated.

5. Balance Homes relaunches with $30M investment

Balance Homes relaunched with $30M led by Falco Group after being shut down under EasyKnock. EasyKnock faced legal challenges from consumers and regulators in multiple states.

It offers equity-sharing to homeowners who have home equity but can’t qualify for traditional credit: Balance provides cash by taking a co-ownership stake (often majority), typically to pay down mortgages and high-interest debt.

Deals run about seven years, with exit options to buy out, refinance, sell, or have Balance buy the rest. The company says it restarted in December 2025, is operating in six states, and plans to expand.

1 funny tweet

☀️ You’re all caught up. See you on Friday!

🚀 Wanna help our newsletter grow? Forward it to a friend or colleague.

Would you like to receive a ready-to-send weekly marketing email for your realtors and/or clients? Start your 30-day free trial here.

Was this email forwarded to you? Subscribe here.

Interested in advertising to 40k+ loan officers? Get in touch.