- Mortgage Nuggets

- Posts

- Mortgage refinance demand surges 40%

Mortgage refinance demand surges 40%

Plus: More mortgages now sit above 6% than 3%

🏖️ Happy Friday! Today’s newsletter is 717 words, a 2.5-minute read.

📧 Programming note: We're out Monday for MLK Day, but we'll be back in your inboxes on Wednesday. Enjoy your long weekend!

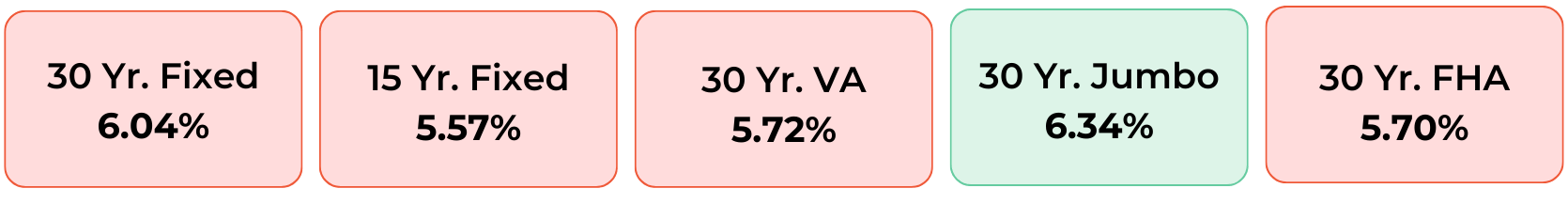

Disclaimer: Average mortgage rates as of January 15, 2026. © MND Daily Rate Index.

1. Mortgage applications rise 28.5%

Mortgage demand rose sharply last week as consumers returned from the holidays to find lower overall interest rates. Total mortgage application volume jumped 28.5% from the previous week (adjusted for the holiday), according to the MBA’s seasonally adjusted index.

For the whole week, the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($832,750 or less) decreased to 6.18% from 6.25%.

Applications for home purchase mortgages increased 16% for the week and were 13% higher than a year ago.

Refinance demand surged 40% for the week and was 128% higher than the same week a year ago.

“Mortgage rates dropped lower last week following the announcement of increased MBS purchases by the GSEs. Lower rates, including the 30-year fixed rate declining to 6.18%, sparked an increase in refinance applications,” said Joel Kan, MBA’s vice president. “Compared to a holiday adjusted week, refinance applications surged 40% to the strongest weekly pace since October 2025.

2. CHLA opposes FHFA’s single-bureau credit pull

The Community Home Lenders of America (CHLA) is pushing back against proposals to allow a single-bureau credit pull in mortgage underwriting, arguing that the main credit bureaus rely on materially different datasets.

The move comes as Federal Housing Finance Agency (FHFA) Director Bill Pulte advocates for changes aimed at increasing competition in credit score usage.

Supporters of a single-bureau approach say it could simplify the mortgage process and reduce costs for borrowers. They note that potential data gaps could be addressed through other means, such as consumer-permissioned bank account data.

Stop Chasing Every Borrower. Start Focusing On the Right Ones.

In today’s market, generic leads don’t convert. Cotality’s data-driven mortgage marketing solutions help brokers identify real opportunities hiding in plain sight—ARM resets, equity-ready homeowners, PMI elimination and past-client re-engagement.

If you’re not using data to locate the right borrowers at the right time, someone else is. See what your competitors already know and act first.

3. More Nuggets

💵 Inflation rose at an annual rate of 2.7% in December. (BLS.gov)

✂️ HUD proposes eliminating disparate impact regulations. (HUD)

🚨 Pending home sales drop to the lowest level on record. (Redfin)

🏠 Investor share of home purchases hits 5-year high. (BatchData)

📈 More mortgages now sit above 6% than 3% for the first time since 2020. (FHFA)

4. Foreclosure filings on properties rose 14% in 2025

Foreclosure filings were reported on 367,460 properties in 2025, up 14% from 2024 and 3% from 2023, according to ATTOM. In December, 44,990 properties had foreclosure filings, a 26% increase from November and 57% higher than a year earlier.

Lenders started the foreclosure process on 289,441 properties in 2025, a 14% increase from 2024. The states with the highest number of foreclosure starts included Texas, Florida, California, Illinois, and New York.

“Foreclosure activity increased in 2025, reflecting a continued normalization of the housing market following several years of historically low levels,” said Rob Barber, CEO at ATTOM. “While filings, starts, and repossessions all rose compared to 2024, foreclosure activity remains well below pre-pandemic norms and a fraction of what we saw during the last housing crisis.”

5. Existing home sales jumped 5.1% in December

Existing home sales rose 5.1% in December from November, marking the fastest pace in nearly three years, according to a report from the National Association of Realtors (NAR).

Despite the surge in sales, inventory levels remained tight. Housing inventory totaled 1.18 million units in December, down 18.1% from November but up 3.5% from December 2024.

The median existing-home price increased 0.4% year over year to $405,400, extending a streak of annual price gains to 30 consecutive months.

☀️ You’re all caught up. See you on Wednesday!

🚀 Wanna help our newsletter grow? Forward it to a friend or colleague.

Would you like to receive a ready-to-send weekly marketing email for your realtors and/or clients? Start your 30-day free trial here.

Was this email forwarded to you? Subscribe here.

Interested in advertising to 40k+ loan officers? Get in touch.