- Mortgage Nuggets

- Posts

- Mortgage rates hit 2025 lows after Powell remarks

Mortgage rates hit 2025 lows after Powell remarks

Plus: USDA is automating its loan application uploading

👋 It's Monday. Thanks for joining us. Today’s newsletter is 694 words, 2.5 minutes.

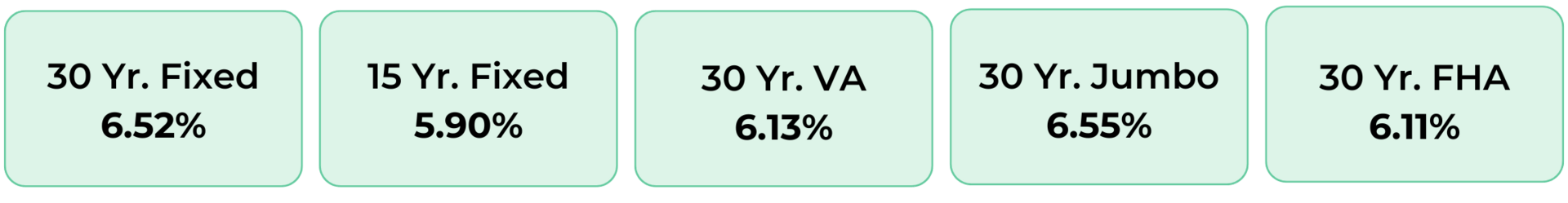

Disclaimer: Average mortgage rates as of August 22, 2025. © MND Daily Rate Index.

1. USDA is automating its loan application uploading

The U.S. Department of Agriculture awarded Phoenixteam a $49 million contract to modernize its Guaranteed Underwriting System, which underpins the agency’s rural loan program.

A key upgrade will be automated loan application uploading — a feature long standard at Fannie Mae and Freddie Mac but absent from USDA’s system, forcing manual data entry that often delayed approvals by weeks. Lenders say the change could cut processing times by up to 50% and lower costs.

“This award is about more than technology — it’s about access to homeownership,” said Phoenixteam CEO Tanya Brennan. “By modernizing USDA’s Guaranteed Underwriting System, we make it easier for lenders to deliver this product, which is often the only path to homeownership for rural families.”

2. Mortgage rates hit 2025 lows after Powell remarks

Mortgage rates dropped to fresh year-to-date lows after Federal Reserve Chair Jerome Powell signaled at Jackson Hole that labor market conditions may outweigh inflation in guiding policy.

The average 30-year fixed rate fell 10 basis points to 6.52% on Friday, according to Mortgage News Daily—the lowest level of 2025. Rates have been trending down since early August despite higher bond yields, as spreads have kept mortgage costs anchored.

If rates fall closer to 6% and hold, housing data could show sustained improvement. Purchase applications have now posted 29 straight weeks of year-over-year gains, with 16 consecutive weeks in double digits.

Fall into better mortgage loan processing with wemlo® 🍂

As the season starts to change, it’s the perfect time to make a change of your own — switch to wemlo and let go of the loan processing stress.

With wemlo’s flexible third-party processing, you can stay focused on what matters most: closing deals, guiding clients, and growing your business.

Why get buried in busywork when you could be peeping leaves or sipping cider? Pass the paperwork to wemlo, soak in the season, and enjoy the crisp fall vibes.

Make the switch. Make it seamless. Make it wemlo.

Book a wemlo demo today.

NMLS ID #1853218

3. More Nuggets

🆕 Trump says he'll fire Fed Governor Lisa Cook 'if she doesn't resign' (CNBC)

🏡 Is Bill Pulte weaponizing the housing regulator. (WSJ)

📝 CHLA opposes Fannie-Freddie merger, asks IMBs to co-sign letter to Bessent and Pulte. (Scotsman Guide)

📊 Charted: Housing markets where home prices are falling. (ResiClub)

💼 Is the real estate industry getting its antitrust enforcement wish? (HousingWire)

4. CFPB closing out hundreds of bank exam red flags as firings loom

The Consumer Financial Protection Bureau has closed out virtually all pending regulatory issues flagged by the agency’s bank examiners as Trump-appointed leaders prepare to fire most remaining staff members.

The CFPB had around 2,000 open “matters requiring attention” in June as Trump-appointed leadership ordered exam teams to prepare memos justifying the to-do items.

As many as 99% of all outstanding MRAs are now set to be closed by the end of this week, according to multiple reports. The CFPB didn’t immediately respond to a request for comment.

5. Rising insurance costs squeeze housing affordability

Homeowners insurance premiums are climbing again, further eroding housing affordability already strained by high rates and prices. The national average is projected to rise 8% in 2025 to $3,520, after double-digit increases in recent years, according to Insurify.

As of late 2024, property taxes and insurance accounted for 32% of the average single-family mortgage payment, the highest share since tracking began in 2014. In Louisiana, insurance alone consumed 18% of monthly payments; Florida, Oklahoma, and Texas also rank among the hardest hit.

Rising replacement costs, supply shortages, and more frequent billion-dollar weather disasters are driving premiums higher. Researchers estimate insurance hikes contributed to 149,000 additional mortgage delinquencies between 2022 and 2023.

☀️ You’re all caught up. See you on Wednesday!

🚀 Wanna help our newsletter grow? Forward it to a friend or colleague.

Would you like to receive a ready-to-send weekly marketing email for your realtors and/or clients? Start your 30-day free trial here.

Was this email forwarded to you? Subscribe here.

Interested in advertising to 40k+ loan officers? Get in touch.