- Mortgage Nuggets

- Posts

- Mortgage rates expected to hold firm even with another Fed cut

Mortgage rates expected to hold firm even with another Fed cut

Plus: Mortgage production costs hit $11,800 per loan

☀️ Thank you for starting your day with us! Today's newsletter is a 2.5-minute read.

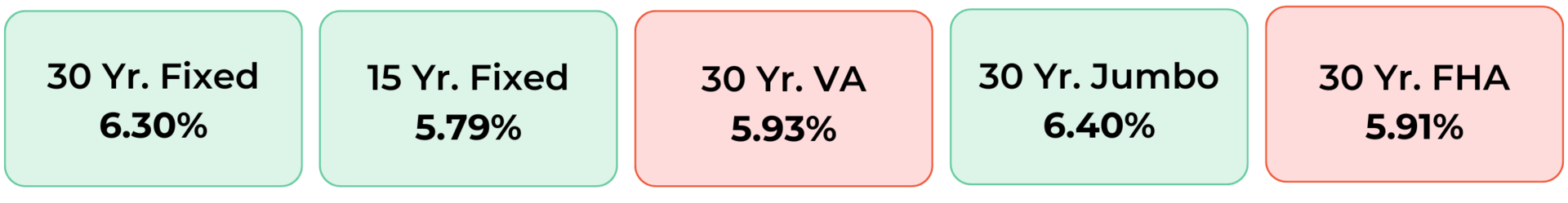

Disclaimer: Average mortgage rates as of December 02, 2025. © MND Daily Rate Index.

1. Mortgage production costs hit $11,800 per loan

Freddie Mac reports that retail lenders spent an average of $11,800 to produce a mortgage in the second quarter of 2025, a slight improvement from the first quarter’s $13,400 but still above year-earlier levels. Despite rising expenses, lenders posted pre-tax income of $900 per loan — the strongest margin since 2021.

The GSE’s updated Cost to Originate Study underscores the persistent rise in production costs and highlights heavier reliance on its Loan Product Advisor system.

Freddie Mac argues that LPA’s automated capabilities can cut roughly $1,700 per loan. “The cost to originate loans continues to rise,” the analysis reported, “but lenders using LPA digital capabilities save $1,700 per loan — about a 13% increase from 2024.”

2. Mortgage rates expected to hold firm even with another Fed cut

Mortgage rates sit near 6.3% entering December, with little change expected even if the Federal Reserve cuts again next week. A key stabilizer has been the narrowing spread between mortgage rates and the 10-year Treasury.

Markets expect a 25-basis-point Fed cut on Dec. 10, bringing the federal funds rate to 3.50%–3.75%, the lowest since 2022. Beyond that, the outlook is murky. Economists anticipate minimal further rate movement but note that rising household incomes could improve affordability by 2026 regardless of rate trends.

Divisions inside the Fed have widened, and President Trump is expected to name Jerome Powell’s successor soon, with Kevin Hassett viewed as the leading candidate to steer rates lower more aggressively.

A MESSAGE FROM COTALITY |

Win your next transaction by building deeper relationships today.

What if you could give your clients a homeownership portal that helps them save thousands and build real wealth?

OneHomeowner is a homeowner engagement tool, designed to help your past clients manage their home, track their equity, and make smarter financial decisions. When you become a trusted resource for vital information, you'll stay top-of-mind and get a powerful competitive edge.

Plus, you'll receive real-time alerts when clients are ready to refinance, giving you the inside track on new business.

Ready to see how you can become an indispensable resource for your clients? Schedule a demo today.

3. More Nuggets

🏦 Chase offers Cyber Monday refinance rate discount. (HousingWire)

📰 MBA lays out proposed changes for federal reverse mortgage programs. (MBA)

💼 GAO urges the FHFA to issue clear, written guidance on how GSEs should meet fair lending requirements. (NMP)

📈 Rising credit report costs may push mortgage industry toward upfront fees. (HousingWire)

🤔 ION: Japan’s new human washing machine launches. It’ll cost you $385K. (Vice)

4. Absolute Home Mortgage acquires assets of Fidelity Direct Mortgage

Absolute Home Mortgage has acquired the assets of Fidelity Direct Mortgage, adding FDM’s 55 loan officers who originated $335 million over the past year.

Absolute, which produced $1 billion with about 190 loan officers in the same period, said the deal expands scale and product reach.

FDM’s president, Maria D’Souza-DaTa, joins Absolute as executive operations manager and a board member, citing the firm’s larger infrastructure and national footprint as essential for long-term competitiveness.

Related news: Fathom sells LiveBy assets to Move Concierge

5. Zillow revises expectations for home value growth

Zillow has released its latest 12-month forecast, projecting that home values will rise 1.5% between October 2025 and October 2026. While that’s modest growth, it’s an improvement compared to April's 12-month forecast, when Zillow predicted a -1.7% drop.

Currently, national prices are up just 0.1% year over year, so a 1.5% gain would represent a slight acceleration.

Here are the top 5 markets where Zillow expects the biggest increases and decreases in home values in percentage terms:

Biggest Increases

| Biggest Decreases:

|

☀️ You’re all caught up. See you on Friday!

🚀 Wanna help our newsletter grow? Forward it to a friend or colleague.

Would you like to receive a ready-to-send weekly marketing email for your realtors and/or clients? Start your 30-day free trial here.

Was this email forwarded to you? Subscribe here.

Interested in advertising to 40k+ loan officers? Get in touch.