- Mortgage Nuggets

- Posts

- Mortgage applications down 4.7%; Refi activity weakens

Mortgage applications down 4.7%; Refi activity weakens

Plus: ChatGPT users can now connect with Zillow in app

Happy Wednesday! Relax your shoulders. Today’s newsletter is a 3.5-minute read.

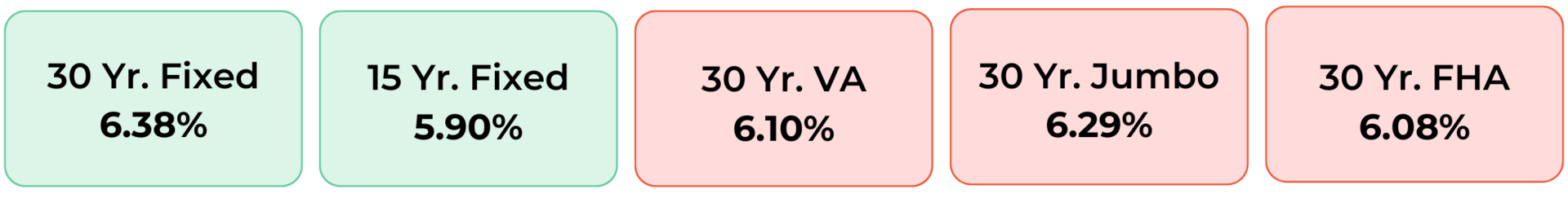

Disclaimer: Average mortgage rates as of October 07, 2025. © MND Daily Rate Index.

1. Mortgage applications down 4.7%; Refi activity weakens

Total mortgage application volume dropped 4.7% last week compared with the previous week, according to the MBA’s seasonally adjusted index.

Applications for a mortgage to purchase a home fell 1% for the week and were 14% higher year over year.

Applications to refinance a home loan, which rose sharply in mid-September and then dropped back again two weeks ago, fell further last week, down 8%. Refinance demand is still 18% higher than it was the same week one year ago.

The average interest rate for 30-year fixed-rate mortgages decreased to 6.43% from 6.46%

“With mortgage rates on fixed-rate loans little changed last week, refinance application activity generally declined, with the exception of a modest increase for FHA refinance applications,” said Mike Fratantoni, chief economist at the MBA.

2. ChatGPT users can now connect with Zillow in app

OpenAI is making it easier for ChatGPT users to connect with third-party apps within the chatbot to carry out tasks, the company’s latest bid to turn its flagship product into a key gateway for digital services.

With the new option, unveiled Monday during OpenAI’s annual developers event, a ChatGPT user can can look up homes in a specific neighborhood on Zillow, without leaving the app. The feature, which OpenAI calls “talking to apps,” requires users to sign in to the apps the first time.

"The Zillow app in ChatGPT shows the power of AI to make real estate feel more human. Together with OpenAI, we’re bringing a first-of-its-kind experience to millions — a conversational guide that makes finding a home faster, easier, and more intuitive." — Josh Weisberg, Head of AI at Zillow

Give the Gift of Homeownership, Get the Advantage of a Lifetime

What if you could give your clients a homeownership portal that helps them save thousands and build real wealth? Now you can.

OneHomeowner is a homeowner engagement tool, designed to help them manage their home, track their equity, and make smarter financial decisions. When you become a trusted resource for vital information, you'll stay top-of-mind and get a powerful competitive edge.

Plus, in an environment where interest rates are dropping, you'll receive real-time alerts when clients are ready to refinance, giving you the inside track on new business.

Ready to see how you can become an indispensable resource for your clients? Schedule a demo today.

3. More Nuggets

💳 Equifax cuts VantageScore 4.0 prices to compete with FICO. (Equifax)

⚖️ Jamie Dimon on government shutdown: ‘A bad idea’. (theHill)

🎥 HousingWire’s Logan Mohtashami: Whenever mortgage rates head near 6%, housing data improves. (CNBC)

🏡 Investors are making up the highest share of homebuyers in 5 years. (MSN)

4. Fannie, Freddie close NY offices

Fannie Mae and Freddie Mac plan to permanently close their New York state offices, citing what officials described as Attorney General Letitia James’s “corrupt and dangerous business practices.”

The move, first reported by Fox News Digital, will not affect the GSEs’ lending in the state, but they intend to sublease their office spaces.

“We’ll still employ New York residents, and we’ll still continue to do mortgage loans in New York, of course,” the source continued. “But we are going to eliminate our physical presence. And to the extent that we have leases, we are going to be subleasing those”

James has denied wrongdoing, calling the allegations politically motivated and blaming any irregularities on paperwork errors. She has been a longtime political opponent of Trump, filing nearly 100 lawsuits against his administration and pledging to continue challenging his policies.

5. Markets where homeownership takes the smallest bite out of income

ATTOM’s Q3 2025 Home Affordability Report shows the typical monthly homeownership cost (mortgage, taxes, insurance) was $2,123, flat from the prior quarter but up 6% year over year. Owning a median-priced home required 33.3% of average wages, a 1.1% rise from last year.

Of the 25 least-affordable counties, 12 were in California and five in New York, underscoring coastal cost pressures. Below are the top 10 most affordable counties (smallest share of annual wages spent on ownership) in Q3 2025:

|

|

☀️ You’re all caught up. See you on Friday!

🚀 Wanna help our newsletter grow? Forward it to a friend or colleague.

Would you like to receive a ready-to-send weekly marketing email for your realtors and/or clients? Start your 30-day free trial here.

Was this email forwarded to you? Subscribe here.

Interested in advertising to 40k+ loan officers? Get in touch.