- Mortgage Nuggets

- Posts

- MBA warns rates to stay above 6% through 2026

MBA warns rates to stay above 6% through 2026

Plus: Letitia James pleads not guilty to charges related to alleged mortgage fraud

☕ Good Monday morning. Today's newsletter is 735 words or a 2.5-minute read.

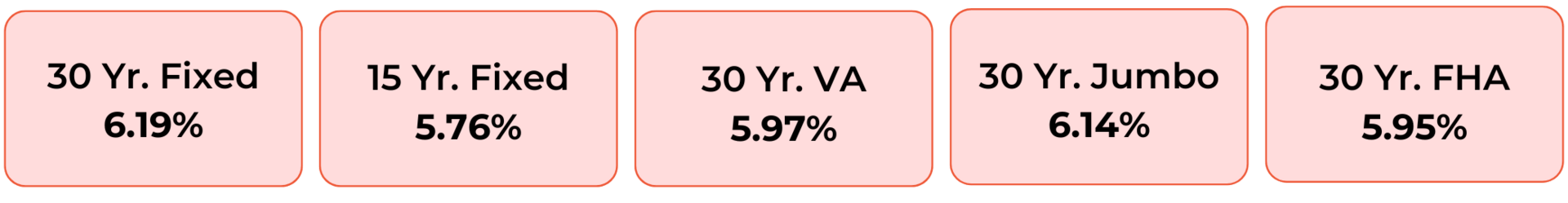

Disclaimer: Average mortgage rates as of October 24, 2025. © MND Daily Rate Index.

1. MBA warns rates to stay above 6% through 2026

Mortgage rates are set to stay stubbornly high, with the Mortgage Bankers Association warning they’ll remain above 6% well into 2026. Speaking at the group’s convention in Las Vegas, Chief Economist Mike Fratantoni said the 10-year Treasury’s 4%–4.5% range “points to mortgage rates going higher rather than lower.”

Economists at the event dismissed hopes for a quick return to sub-6% loans, citing tariffs and rising inflation as persistent headwinds. “After all that work to get inflation under control, it sure looks like it’s going the other way,” Fratantoni said.

The MBA expects the Fed to cut rates twice more this year and once in 2026, but not enough to move mortgage costs meaningfully lower. For borrowers, the message was blunt: the era of cheap money is over, and 6% is the new normal.

2. Letitia James pleads not guilty to criminal charges related to alleged mortgage fraud

New York Attorney General Letitia James pleaded not guilty Friday to federal mortgage fraud charges brought by the Trump administration.

James faces one count each of bank fraud and making false statements to a financial institution, charges that carry a potential 30-year sentence apiece. Prosecutors allege she misrepresented a Virginia home as a secondary residence to obtain a more favorable mortgage rate before renting it out.

Appearing in federal court in Norfolk, Va., James denounced the case as a politically motivated effort by President Trump to punish critics.

Give the Gift of Homeownership, Get the Advantage of a Lifetime

What if you could give your clients a homeownership portal that helps them save thousands and build real wealth? Now you can.

OneHomeowner is a homeowner engagement tool, designed to help them manage their home, track their equity, and make smarter financial decisions. When you become a trusted resource for vital information, you'll stay top-of-mind and get a powerful competitive edge.

Plus, in an environment where interest rates are dropping, you'll receive real-time alerts when clients are ready to refinance, giving you the inside track on new business.

Ready to see how you can become an indispensable resource for your clients? Schedule a demo today.

3. More Nuggets

🤖 AI isn't taking banking jobs, Goldman Sachs CEO says. (Axios)

💼 Shopping around for a lender could save borrowers up to $44,000. (MorningStar)

⛓️ ION: Suspects in Louvre jewel heist case arrested. (ABC News)

🕵 Cotality expands into the home inspector industry; launches Property Vision. (CTL)

🧮 UWM announces three new broker tools at AIME Fuse. (UWM)

4. Consumer sentiment drops to five-month low

Consumer sentiment fell in October to a five-month low, as worries persisted about stubbornly high prices and the impact on their finances.

The final October sentiment index fell to 53.6 from 55.1 in September, a deterioration from the preliminary reading, according to the University of Michigan. A measure of current conditions dropped to the lowest since August 2022.

“Overall, consumers perceive few material changes in economic circumstances from last month; inflation and high prices remain at the forefront of consumers’ minds,” Joanne Hsu, director of the survey, said in a statement. “There was little evidence this month that consumers connect the federal government shutdown to the economy.”

5. Fannie Mae names new head of single family and acting general counsel

Fannie Mae promoted two longtime executives to key leadership posts amid a broader management reshuffle and speculation the mortgage giant could go public by late 2025.

Jake Williamson was named acting head of Single-Family, succeeding Malloy Evans, while Tom Klein was appointed acting general counsel, replacing Danielle McCoy. Both have roughly two decades at Fannie Mae.

The changes follow the exit of CEO Priscilla Almodovar, who will receive $1.2 million in severance and extended benefits.

“These highly respected leaders will help lead the company to increased safety and soundness and accelerated profitability,” said FHFA Director Bill Pulte. Acting CEO Peter Akwaboah said the promotions strengthen Fannie’s “rock-solid foundation.”

☀️ You’re all caught up. See you on Wednesday!

🚀 Wanna help our newsletter grow? Forward it to a friend or colleague.

Would you like to receive a ready-to-send weekly marketing email for your realtors and/or clients? Start your 30-day free trial here.

Was this email forwarded to you? Subscribe here.

Interested in advertising to 40k+ loan officers? Get in touch.