- Mortgage Nuggets

- Posts

- LendingTree January is the best month to buy

LendingTree January is the best month to buy

Plus: Plaid unveils new credit risk score model

⚠️ Back at it for another week. Today’s newsletter is 740 words, a 2.5-minute read.

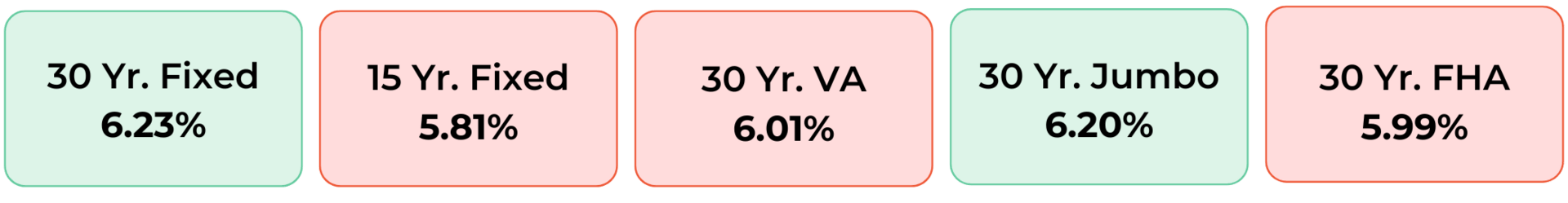

Disclaimer: Average mortgage rates as of October 17, 2025. © MND Daily Rate Index.

1. LendingTree January is the best month to buy

LendingTree research shows January is the best month to buy a home, with prices about 8% lower than May, saving buyers roughly $23,000 on a 1,500sqft house.

The slow sales pace and reduced competition make sellers more willing to negotiate. Homes listed in January sit on the market a median of 75 days, compared to 48 days in spring.

Inventory is thinner in winter, but motivated sellers and fewer bidding wars create better deals, especially for first-time buyers not tied to selling an existing home.

“While there may be less inventory in the winter, you may find less competition for available homes,” he said. “You might also find that sellers are more eager to bargain during those off-peak times, not wanting to alienate buyers.”

2. Plaid unveils new credit risk score model

Plaid has introduced a credit risk score that it said provides lenders with an up-to-date view of borrower risk by using real-time cash flow data and unique account connection insights from the Plaid Network.

The new Plaid LendScore provides a more complete financial picture by accounting for variable income, fluctuating expenses and financial activity that is spread across multiple platforms, the company said in a Wednesday (Oct. 15) blog post.

Plaid LendScore is now available in beta, and the company has posted a waitlist for those who want to join, according to the post.

The Insurance Agency Built for Mortgage

Insurance roadblocks shouldn't be costing you deals. When borrowers struggle to find coverage that meets mortgage requirements, closings can get delayed.

Covered specializes in solving insurance challenges unique to mortgage institutions:

55+ top-rated carriers with dedicated difficult market access – Coverage solutions even in hard-to-insure areas

Pre-built integrations with Blend, ICE Servicing Digital, and Blue Sage – Turnkey integrations make implementation a breeze.

Full mortgage lifecycle support – Solutions from origination through servicing and refinance

Covered is the specialty shop that understands mortgage workflows, is built into mortgage tech, and supports your borrowers. If insurance is a pain point worth solving, work with the agency purpose-built for mortgage.

3. More Nuggets

💼 Rocket trims workforce after completing Mr. Cooper acquisition. (HousingWire)

📉 Rates hold steady just above 3 year lows. (MND)

🏘️ These are America's 50 fastest growing housing markets by population. (ResiClub)

🏦 Fifth Third, Truist flag nonbank lending. (BankingDive)

👀 Three real estate things to watch as shutdown goes on. (TheRealDeal)

4. Housing affordability a major concern for Gen Z

A Realtor.com survey found that 67% of Gen Z adults view homeownership as a key life goal despite widespread affordability concerns.

Eighty-two percent believe buying a home is harder for their generation, and 16% rank housing costs among their top life worries. Most are prioritizing career advancement before homebuying, with nearly half saving for downpayments averaging $54,500.

About one-third are taking extra jobs to save, avoiding high-risk investments or family loans. Price ranks as the top factor in choosing a home, followed by size and location. Forty percent prefer waiting for a “forever home,” while 30% plan to start smaller and trade up.

5. MBA forecasts $2.2T mortgage origination in 2026

The MBA projects $2.2 trillion in total mortgage originations for 2026, up from $2.0 trillion in 2025. Purchase loans are expected to rise 7.7% to $1.46 trillion, while refinances increase 9.2% to $737 billion.

Chief economist Mike Fratantoni said modest economic growth, rate cuts by the Fed, and improving housing supply will lift home sales next year. Mortgage rates are expected to stay between 6% and 6.5%, with 10-year Treasury yields above 4%. Home prices should flatten or decline slightly as inventories rise.

Regional differences will persist: markets like Florida and Arizona face price drops, while tight supply in the Northeast and Midwest keeps prices climbing. Borrowers are turning to adjustable-rate and FHA loans to manage affordability.

☀️ You’re all caught up. See you on Wednesday!

🚀 Wanna help our newsletter grow? Forward it to a friend or colleague.

Would you like to receive a ready-to-send weekly marketing email for your realtors and/or clients? Start your 30-day free trial here.

Was this email forwarded to you? Subscribe here.

Interested in advertising to 40k+ loan officers? Get in touch.