- Mortgage Nuggets

- Posts

- Lenders warn credit card rate cap could weigh on mortgage access

Lenders warn credit card rate cap could weigh on mortgage access

Plus: Trade groups call on HUD, FHFA to reduce mortgage fees

👋 Heyo, Monday. Today's newsletter is 615 words, a 2.5-minute read. Let’s dive in…

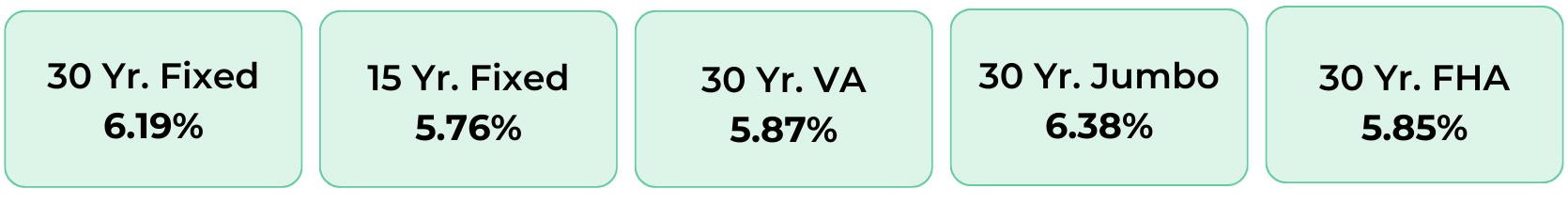

Disclaimer: Average mortgage rates as of January 23, 2026. © MND Daily Rate Index.

1. Senior home equity surges to record $14.7T

Older U.S. homeowners reached a record level of housing wealth in the third quarter of 2025, with those aged 62 and older holding $14.66 trillion in home equity.

This marked a 1.9% quarterly increase and surpassed the prior record of $14.39 trillion set in Q2 2025, driven primarily by rising home values and continued equity accumulation.

“The latest release of the RMMI underscores the extraordinary level of housing wealth held by older Americans,” NRMLA President Steve Irwin said. “At a time when inflation pressures and the fear of outliving one’s retirement savings remain top concerns for retirees, home equity stands out as a powerful — yet often underutilized — financial resource.”

2. Lenders warn credit card rate cap could backfire on homebuyers

Mortgage lenders are warning that a proposed federal cap on credit card interest rates could undermine homebuying by restricting consumer credit.

President Donald Trump has called for a one-year 10% cap, arguing that high card rates impede savings for down payments, but industry participants say the policy could trigger unintended consequences.

Lenders expect credit card issuers to respond by tightening standards, reducing credit limits, or closing accounts to offset lower returns. Such moves would raise credit utilization ratios and depress credit scores, weakening mortgage eligibility even as cardholders see lower interest charges.

A MESSAGE FROM MORTGAGE NUGGETS

Break through the noise

Reach execs and business leaders with Mortgage Nuggets.

We'll help you tell your story in the right way:

We'll distill your brand’s message into its most effective form.

No clutter, no filler — just clean, smart and effective.

3. More Nuggets

📈 Prepayments jump as lower rates spur December refi surge. (NMN)

🎥 TikTok forms US entity, easing marketing concerns for mortgage pros. (Axios)

⏸️ Trump pulls back from 401(k) use for down payments. (Fox)

4. Trade groups call on HUD, FHFA to reduce mortgage fees

The Mortgage Bankers Association, America’s Credit Unions, and the Independent Community Bankers of America are urging the White House to take administrative steps to reduce mortgage costs.

They request that HUD lower FHA mortgage insurance premiums, potentially removing the life-of-loan requirement, and that the tri-merge credit reporting requirement be eliminated in favor of a single-credit-report framework for Fannie Mae– and Freddie Mac–backed loans.

Additionally, they call on the FHFA to reduce loan-level price adjustments on conventional mortgages and eliminate certain refinance fees. Read the full letter here.

5. TCPA class action lawsuits surge against lenders

Mortgage lenders are facing an uptick in lawsuits under the Telephone Consumer Protection Act (TCPA), alleging unwanted calls or texts to consumers on the Do Not Call registry.

At least eight new complaints have emerged recently, including two against United Wholesale Mortgage (UWM). Other lenders recently hit with TCPA claims include 360 Lending, Federal Savings Bank, Lending Force, Leadpoint, Royal United Mortgage, and E Mortgage Capital, some facing multiple lawsuits.

TCPA litigation can stretch for years, with some cases dismissed quickly and others resulting in large settlements. Recent examples include Freedom Mortgage paying $502,000 in 2023 and Anywhere Real Estate agreeing to a $20 million settlement for over 700,000 calls to 300,000 class members.

☀️ You’re all caught up. See you on Wednesday!

🚀 Wanna help our newsletter grow? Forward it to a friend or colleague.

Would you like to receive a ready-to-send weekly marketing email for your realtors and/or clients? Start your 30-day free trial here.

Was this email forwarded to you? Subscribe here.

Interested in advertising to 40k+ loan officers? Get in touch.