- Mortgage Nuggets

- Posts

- HUD blames ‘radical left’ for government shutdown

HUD blames ‘radical left’ for government shutdown

Plus: UWM pays $115M for 10-year naming rights to Phoenix Arena

😅 Finally Friday. Today’s newsletter is 633 words, a 2.5-minute read. Let’s dive in…

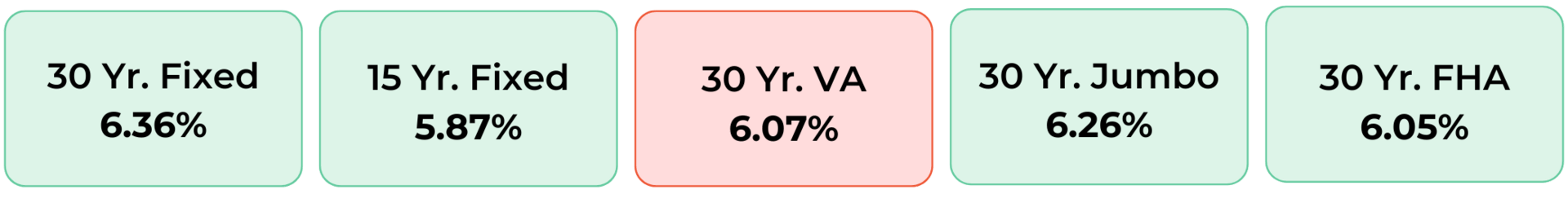

Disclaimer: Average mortgage rates as of October 03, 2025. © MND Daily Rate Index.

1. HUD blames ‘radical left’ for government shutdown

Americans who visited the U.S. Department of Housing and Urban Development’s website Tuesday were greeted with an unusual message blaming Democrats for an impending government shutdown.

"The Radical Left are going to shut down the government and inflict massive pain on the American people unless they get their $1.5 trillion wish list of demands," a pop-up on HUD.gov reads. "The Trump administration wants to keep the government open for the American people."

Congressional Democrats panned the overtly partisan messaging as government propaganda and misinformation, though some said they were unsurprised.

"We should not be putting political messages on government webpages," said Representative Sylvia Garcia of Texas, a member of the House Financial Services Committee’s subcommittee on housing and insurance. "I have never seen that kind of message. I don’t think that would be acceptable with any other prior administration."

2. UWM pays $115M for 10-year naming rights to Phoenix Arena

The Phoenix Suns and Phoenix Mercury have a new name for their home arena – the Mortgage Matchup Center.

The teams announced Thursday that they have come to an agreement with national mortgage lender United Wholesale Mortgage on a 10-year, nearly $115 million naming rights partnership. Mortgage Matchup is UWM's consumer-facing brand and website.

The Suns and Michigan-based UWM have previous connections, considering both are run by the same person. Mat Ishbia is the president CEO of UWM and is the son of the company’s founder. Ishbia became the Suns’ majority owner in 2023.

You’ll never get ghosted by wemlo® loan processing services 👻

Processing all on your own can be scary business, but with wemlo, you’ll never be left in the dark.

Pass the processing operations to wemlo – our processing pod approach means you’ll have a go-to manager and two dedicated processors you can count on for every loan submitted.

No more haunting follow-ups. No more vanishing processors. Just seamless support.

Clear communication, efficient processing, and a team that's got your back – this spooky season it’s all treats and no tricks with wemlo.

Book a wemlo demo today.

NMLS ID #1853218

3. More Nuggets

🏦 How the U.S. government shutdown may impact mortgage rates. (CNBC)

💼 Jay Bray now CEO of Rocket Mortgage. (Rocket)

💸 West Capital Lending partners with Mortgage Connections. (PremierPlus)

🧨 Federal layoffs day or two away, budget director tells Republicans. (theHill)

⚖️ CrossCountry seeks dismissal in kickback suit. (HousingWire)

📰 5 states sue Zillow, Redfin over $100M rental agreement one day after FTC suit. (Reuters)

4. FICO launches cost-cutting direct license program for mortgage lending

FICO has launched a Mortgage Direct License Program that lets tri-merge resellers distribute credit scores directly to lenders, bypassing credit bureaus and cutting costs.

The program offers two pricing models: a $4.95 royalty per score under a performance-based structure—about 50% cheaper than current fees—or a $10 per-score model. FICO says the change will eliminate bureau markups and give lenders more pricing flexibility.

The move comes amid regulatory pressure and competition from VantageScore. Policy changes dating back to 2018 opened the door for alternative models, and recent FHFA updates allowing bi-merge credit reports could threaten a third of FICO’s profits.

5. Fannie and Freddie waive some loan requirements amid shutdown

Fannie Mae and Freddie Mac issued temporary guidance to keep lending moving during the government shutdown, easing some documentation rules.

Lenders can use year-to-date pay statements instead of 30-day paystubs and document attempts to verify employment if federal systems are down. Income, tax, and Social Security checks are still required, but some timelines are relaxed.

The shutdown also affects flood insurance and servicing. Lenders must rely on pending or private flood coverage until the National Flood Insurance Program resumes. Fannie and Freddie are allowing forbearance for affected borrowers.

☀️ You’re all caught up. See you on Monday!

🚀 Wanna help our newsletter grow? Forward it to a friend or colleague.

Would you like to receive a ready-to-send weekly marketing email for your realtors and/or clients? Start your 30-day free trial here.

Was this email forwarded to you? Subscribe here.

Interested in advertising to 40k+ loan officers? Get in touch.