- Mortgage Nuggets

- Posts

- Homeowners turn to cash-out refinancing

Homeowners turn to cash-out refinancing

Plus: FTC warns of surge in scams targeting seniors

🎉 Hey there. Happy Wednesday. Today's newsletter is 648 words, a 2.5-minute read.

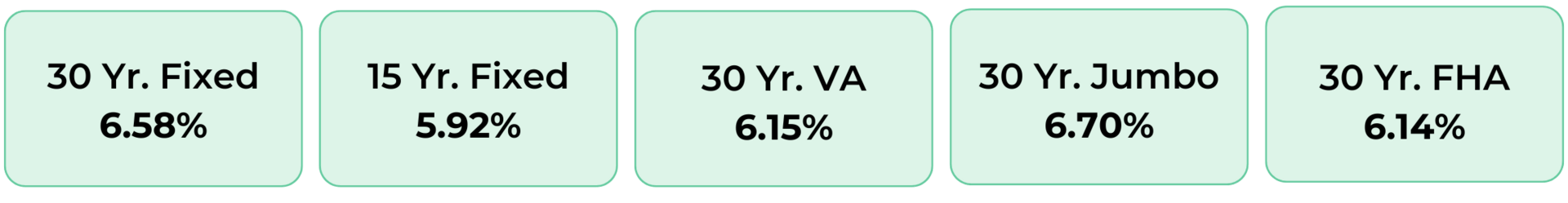

Disclaimer: Average mortgage rates as of August 12, 2025. © MND Daily Rate Index.

1. Homeowners turn to cash-out refinancing

ICE Mortgage Technology has released its August 2025 Mortgage Monitor report. Data shows mortgage originations hit their highest quarterly volume since 2022, with both purchase and cash-out refinance activity nearing three-year highs. Total and tappable home equity volumes also reached record levels.

Cash-out refinances made up 59% of all refinance transactions in Q2. Remarkably, 70% of those borrowers accepted higher interest rates — averaging a 1.45-point increase — to access an average of $94,000 in home equity. Their monthly payments rose by about $590.

Cash-out borrowers generally had lower average credit scores (719) and smaller loan balances ($188,000) than their rate-and-term counterparts.

“Homeowners are actively drawing on record equity with cash-out refinance loans, signaling increased demand despite elevated rates. Meanwhile, a substantial cohort of people who purchased homes over the last three years are watching on the sidelines for rates to drop so they can refinance into a lower monthly payment.”

2. FTC warns of surge in scams targeting seniors

The Federal Trade Commission (FTC) is warning about a steep increase in high-dollar losses among older Americans due to sophisticated impersonation scams. Losses have more than quadrupled since 2020.

The agency’s latest Consumer Protection Data Spotlight shows reports from consumers aged 60+ who lost $10,000 or more have surged. Losses topping $100,000 jumped from $55 million in 2020 to $445 million in 2024 — an eightfold increase.

While scammers target all ages, older adults are hit hardest in the biggest cases, with some losing their entire life savings.

A MESSAGE FROM THE HUSTLE DAILY

200+ AI Side Hustles to Start Right Now

From prompt engineering to AI apps, there are countless ways to profit from AI now. Our guide reveals 200+ actionable AI business models, from no-code solutions to advanced applications. Learn how people are earning $500-$10,000 monthly with tools that didn't exist last year. Sign up for The Hustle to get the guide and daily insights.

3. More Nuggets

🏠 NAR commends FHFA decision to raise caps on LIHTC spending. (NAR)

🚀 Acra Lending appoints Shawn Stone new CEO. (HousingWire)

💸 More than half of buyers are betting on a refi lifeline. (NMP)

⚠️ States with the most seriously underwater mortgages. (ATTOM)

4. Buyers are back in charge as homes sell below ask

In May, 56% of homes sold for less than asking, with the median closing price coming in $45,000 lower than the list price, according to new data from Cotality.

Key findings from the report:

Buyers need about $200,000 more to afford the median-priced home compared to 10 years ago.

More homes are sitting on the market longer, especially in Texas and Florida.

Sales are down in Naples and Miami, but Miami’s median home price is up 7% year over year.

Over 1.1 million homes are for sale, with an average market time of 58 days.

5. Mortgage rates drop to the lowest level since April

After a softer-than-expected jobs report, the Freddie Mac 30-year mortgage rate fell 9 basis points to 6.63%, while the daily average 30-year fixed rate tracked by Mortgage News Daily dropped to 6.58%.

For a buyer with a $3,000 monthly budget, that dip means they can now afford a $458,750 home — about $20,000 more than in May, when rates peaked at 7.08%.

Median asking prices are up just 2.3% year over year, one of the smallest gains in the past two years, and Redfin forecasts that sale prices will dip by 1% by year’s end. Only 26.6% of homes are now selling above asking price, down from 31% a year ago, signalling less competition and more negotiating room for buyers.

A MESSAGE FROM 1440 MEDIA

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

☀️ You’re all caught up. See you on Friday!

🚀 Wanna help our newsletter grow? Forward it to a friend or colleague.

Would you like to receive a ready-to-send weekly marketing email for your realtors and/or clients? Start your 30-day free trial here.

Was this email forwarded to you? Subscribe here.

Interested in advertising to 40k+ loan officers? Get in touch.