- Mortgage Nuggets

- Posts

- Homebuyers in America seem to be getting cold feet

Homebuyers in America seem to be getting cold feet

Plus: HUD terminates Equity Prime Mortgage’s FHA lending approvals

👋 Good morning. Don’t suck today… Are we doing National Encouragement Day right? It was made an official US-recognized thing in 2011 by congressional act.

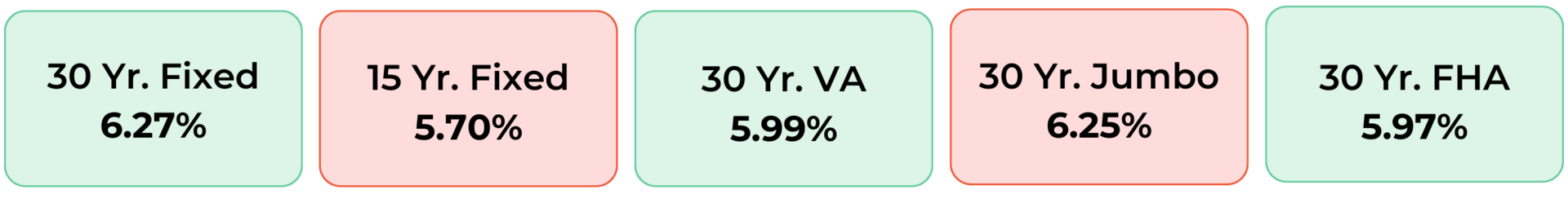

Disclaimer: Average mortgage rates as of September 11, 2025. © MND Daily Rate Index.

1. HUD terminates Equity Prime Mortgage’s FHA lending approvals

HUD revoked Equity Prime Mortgage’s authority to approve FHA loans in New York, Jacksonville, Orlando, and Louisville after finding its loans had default and claim rates more than twice the regional average and above the national average.

The move falls under HUD’s Credit Watch Termination Initiative, which monitors lenders’ performance. Loans approved before Aug. 22 remain eligible, but new FHA loans in the affected areas must go through another approved lender.

EPM can reapply for direct endorsement authority after six months if it provides an independent loan review and corrective action plan. The company has not publicly commented on the action.

2. UWM raises $1B in oversubscribed debt offering

United Wholesale Mortgage issued $1 billion in senior notes, upsized from an initial $600 million target, ahead of $800 million in notes maturing this November. Proceeds will repay that debt, reduce MSR facilities, and fund working capital.

The new 2031 notes carry a 6.25% coupon and rank pari passu with existing senior unsecured debt. CFO Rami Hasani had flagged the refinancing in August, citing “strong investor demand.”

UWM last tapped debt markets in December 2024, raising $800 million. As of Q2, the company reported $3.3 billion in non-funding debt, a 1.9 debt-to-equity ratio, and $2.2 billion in liquidity. Other mortgage lenders including Rocket, Pennymac, and Rithm have also recently raised debt.

Realtors Ignoring Your Emails?

It’s not you—it’s your subject lines, topics, and calls to action.

In this webinar, I’ll show you how to craft emails Realtors actually OPEN, RESPOND to, and REMEMBER you for.

👉 Don’t stay invisible. [Sign up now] Sept 16th 1pm central

— Dave Krichmar CEO

3. More Nuggets

🥊 I’m gonna punch you in your f--king face’: Treasury secretary Scott Bessent threatens FHFA’s Bill Pulte. (Politico)

🤖 3 ways AI is redefining visibility in the loan process for operations teams. (Maxwell)

🌆 These 7 major cities are favoring buyers as the U.S. housing market reaches a ‘rare state of balance’ (CNBC)

📰 Anthony Marone’s double life juggling lending and cold, hard justice. (NMP)

💳 FICO isn't the problem. A premature two-score system is. (National Mortgage News)

🤝 Fairway launches partnership with ChatGPT maker OpenAI. (Fairway)

4. Opendoor stock soars more than 75% as Shopify COO hired to lead company

Opendoor stock rocketed 78% higher on Thursday after the retail favorite named Shopify executive Kaz Nejatian as CEO and co-founder Keith Rabois as chairman.

The meme stock hit a 52-week high and continued a stunning run this year, with shares up more than 500% so far.

Former CEO Carrie Wheeler resigned last month following a pressure campaign from investors that included critical comments from Rabois and hedge fund manager Eric Jackson, who has been a key part of the stock’s resurgence this year.

5. Homebuyers in America seem to be getting cold feet

In July, 15.3% of home-purchase agreements fell through across the U.S. That works out to about 58,000 agreements — the highest cancellation rate for July on record. That’s according to data from Redfin, which blames high homebuying costs for making buyers “skittish.”

But the high costs of buying a home aren’t the only cause for this increased cancellation rate. Economic uncertainty — which includes rising inflation and a slowing labor market — isn’t exactly spurring on buyers who may already have cold feet.

“Buyers are having economic nausea — they’re feeling queasy about the market,” Jeremy Caleb Johnson, an associate broker with Long & Foster in Virginia Beach, told Bloomberg. "Sometimes it’s easier for them to cancel and get some fresh air and breathe.”

A MESSAGE FROM PACASO

Keep This Stock Ticker on Your Watchlist

They’re a private company, but Pacaso just reserved the Nasdaq ticker “$PCSO.”

No surprise the same firms that backed Uber, eBay, and Venmo already invested in Pacaso. What is unique is Pacaso is giving the same opportunity to everyday investors. And 10,000+ people have already joined them.

Created a former Zillow exec who sold his first venture for $120M, Pacaso brings co-ownership to the $1.3T vacation home industry.

They’ve generated $1B+ worth of luxury home transactions across 2,000+ owners. That’s good for more than $110M in gross profit since inception, including 41% YoY growth last year alone.

And you can join them today for just $2.90/share. But don’t wait too long. Invest in Pacaso before the opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

☀️ You’re all caught up. See you on Monday!

🚀 Wanna help our newsletter grow? Forward it to a friend or colleague.

Would you like to receive a ready-to-send weekly marketing email for your realtors and/or clients? Start your 30-day free trial here.

Was this email forwarded to you? Subscribe here.

Interested in advertising to 40k+ loan officers? Get in touch.