- Mortgage Nuggets

- Posts

- Fifth Third to acquire Comerica for $10.9B

Fifth Third to acquire Comerica for $10.9B

Plus: Trump urges GSE’s to boost homebuilding

🫡 Without further ado, Monday. Today’s newsletter is 697 words, a 2.5-minute read.

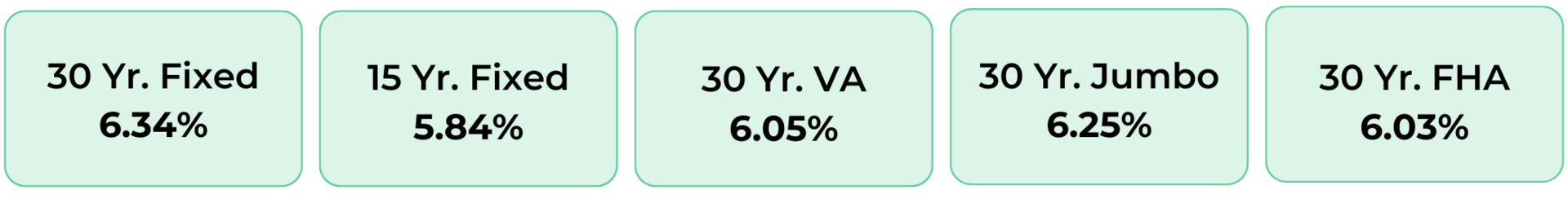

Disclaimer: Average mortgage rates as of October 03, 2025. © MND Daily Rate Index.

1. Fifth Third to acquire Comerica for $10.9B

Fifth Third will acquire Comerica for $10.9 billion in stock, the lenders said today, in what would be the largest bank deal announced thus far in 2025.

The deal, expected to close in the first quarter of 2026, will create the ninth-largest U.S.-based bank with roughly $288 billion in assets.

Under the terms of the deal, Comerica stockholders will receive 1.8663 Fifth Third shares for each Comerica share owned at $82.88 per share, based on Fifth Third’s closing price from Friday and a 20% premium to Comerica’s 10-day volume-weighted average stock price.

“Together, we are creating a stronger, more diversified bank that is well-positioned to deliver value for our shareholders, customers, and communities – starting today, and over the long-term.” Fifth Third CEO Tim Spence said.

2. Trump urges GSE’s to boost homebuilding

President Donald Trump has called on Fannie Mae and Freddie Mac to push major homebuilders to increase construction, citing the roughly 2 million empty lots they control.

In a Truth Social post, he compared the builders’ behavior to OPEC’s past control of oil prices and urged the GSEs to “get Big Homebuilders going” to help restore the American Dream.

It is still unclear how Fannie and Freddie would create incentives for builders. Their role is to buy loans from lenders and set mortgage standards, not to finance or regulate builders directly.

“Before I was President, OPEC kept oil prices high — unfairly. Now, Big Homebuilders are doing something similar. They’ve got financing and are sitting on a record 2 million empty lots. I’m asking Fannie Mae and Freddie Mac to push them to build and help restore the American Dream.”

Top LOs Are Moving to Canopy

In today’s market, successful Loan Officers and Branch Managers demand more: better pricing, cutting-edge tech, true transparency, supportive leadership—and a bigger paycheck.

Hear directly from top producers who made the switch to Canopy Mortgage—transforming their business, boosting income, and gaining control of their work-life balance.

3. More Nuggets

🇺🇸 Americans hit with 100 scam attempts every month. (StudyFinds)

⚖️ Why a federal judge dismissed RICO accusations against UWM. (NMN)

🆕 NEXA Mortgage rebrands to NEXA Lending. (LRE)

🫐 ION: Berries are America’s top-selling fruit — and every parent’s grocery bill nightmare. (theHustle)

4. Flagstar mortgage escrow ruling upheld

The Ninth Circuit has upheld a ruling that Flagstar Bank must follow California’s law requiring interest payments on mortgage escrow accounts, rejecting the bank’s argument that federal law overrides state rules.

Flagstar had asked the court to revisit the case after the U.S. Supreme Court’s Cantero ruling, which sent a similar New York case back for further review. The panel said Cantero didn’t overturn prior Ninth Circuit precedent (Lusnak v. BofA), so the lower court’s decision stands.

Flagstar plans to appeal, arguing the ruling ignores Supreme Court guidance. A separate First Circuit decision against Citizens Bank last month also relied on Cantero, signaling wider legal challenges for lenders over state escrow interest laws.

5. Home sellers cutting prices at record pace

In August, 16.7% of sellers reduced asking prices, the biggest share of any August on record, with homes typically selling 3.8% below list price, the steepest average discount since 2019.

According to Redfin, high housing costs, rising inventory, and economic uncertainty have forced sellers to adjust expectations, tilting the market in buyers’ favor. Single-family homes are driving the trend, with price drops becoming more common in nearly every major U.S. metro.

“Supply is stacking up and we’re seeing price drop after price drop. House hunters are still on the fence, hoping mortgage rates come down more before they buy. But the buyers who are jumping in now are the ones who are getting a good deal.” said Crystal Zschirnt, a Redfin Premier agent in Dallas

☀️ You’re all caught up. See you on Wednesday!

🚀 Wanna help our newsletter grow? Forward it to a friend or colleague.

Would you like to receive a ready-to-send weekly marketing email for your realtors and/or clients? Start your 30-day free trial here.

Was this email forwarded to you? Subscribe here.

Interested in advertising to 40k+ loan officers? Get in touch.