- Mortgage Nuggets

- Posts

- FICO hits back, claims score 10 T crushes VantageScore 4.0

FICO hits back, claims score 10 T crushes VantageScore 4.0

Plus: Top builders keep growing

👋 Good morning. This is Mortgage Nuggets. The email that tells you what's going on in the mortgage industry, in plain jane English. Today’s newsletter is a 2-minute read.

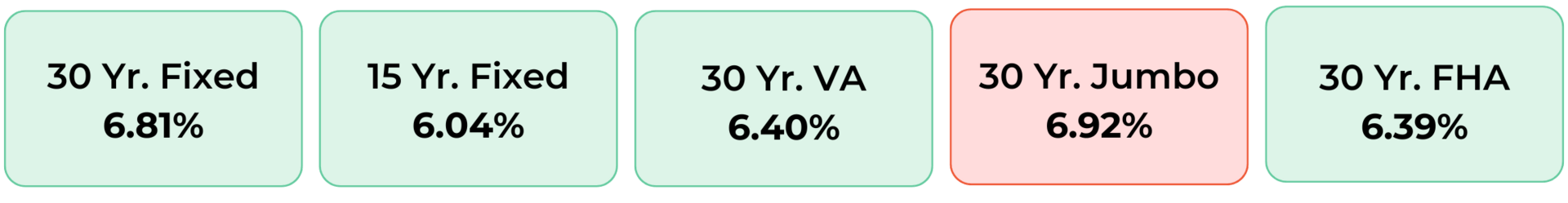

Disclaimer: Average mortgage rates as of July 18, 2025. © MND Daily Rate Index.

1. FICO hits back, claims score 10 T crushes VantageScore 4.0

The Federal Housing Finance Agency’s move to allow VantageScore 4.0 alongside FICO scores for GSE-backed mortgages has triggered pushback from Fair Isaac Corp.

In a new white paper, FICO claims its Score 10 T “materially outperforms” VantageScore 4.0, identifying 18% more defaulters in the riskiest borrower segment versus VantageScore’s 3.4%. FICO says this gives lenders sharper risk assessment, better pricing precision, and higher approval rates.

Additionally, FICO argues that VantageScore’s reliance on mortgage history penalizes renters and underserved groups, while Score 10 T excludes mortgage data but incorporates rental history when available.

I am glad to see FICO and Vantage Score competing today. Today, FICO released a white paper arguing theirs is more predictive than Vantage. This is good. We need COMPETITION. I believe there will be more than 2 credit scores, with high predictability, and low costs.

— Pulte (@pulte)

6:37 PM • Jul 16, 2025

2. Top builders keep growing

The nation’s top 10 builders increased their share of new home sales from less than 10% in 1989 to nearly 50% 35 years later, hitting a record 44.7% in 2024. That translates to 306,932 closings out of 686,000 new single-family homes sold last year.

D.R. Horton led the group with 13.7% of all new home sales, followed by Lennar at 11%. Pulte Group captured 4.3%, and NVR accounted for 3.1%. Meritage Homes held a 2.1% share.

Sekisui House, via its U.S. subsidiary SH Residential Holdings, entered the top ranks after acquiring M.D.C. Holdings in 2024. This acquisition propelled it into sixth place.

KB Home, Taylor Morrison, Century Communities, and Toll Brothers rounded out the top ten. Each of the latter two controlled 1.4% of the market.

Clayton Properties Group, a regular top-10 contender since 2019, dropped out of the rankings for the first time.

A MESSAGE FROM THE DAILY UPSIDE

Wall Street’s Morning Edge.

Investing isn’t about chasing headlines — it’s about clarity. In a world of hype and hot takes, The Daily Upside delivers real value: sharp, trustworthy insights on markets, business, and the economy, written by former bankers and seasoned financial journalists.

That’s why over 1 million investors — from Wall Street pros to Main Street portfolio managers — start their day with The Daily Upside.

Invest better. Read The Daily Upside.

3. More Nuggets

🗺️ Map shows where homeowners are behind on mortgage payments. (NewsWeek)

🆕 Mutual of Omaha expands proprietary reverse mortgage offering to more states. (HECMWorld)

🚒 Why does a fire truck cost $2 million? (theHustle)

🤖 MMI unveils AI interface to help LOs find granular mortgage data. (HW)

⚖️ Lawsuit alleges loanDepot illegally tied loan officer pay to borrower costs. (NMP)

4. New partnership gives San Diego realtors access to assumable loan listings

AssumeList, a platform that helps identify homes with assumable mortgages, has partnered with the San Diego Association of Realtors (SDAR) to expand access to these listings.

Under the deal, SDAR members get discounted subscriptions, specialized training, and access to a nationwide database of assumable listings, as well as connections to second mortgage lenders and transaction support for 30-45 day closings.

“At SDAR, we’re always seeking out tools that give our members and our home buyers and sellers a competitive edge,” Chris Anderson, president of the SDAR board of directors, said in a statement. “AssumeList is that edge — providing unique financing options that help REALTORS serve their clients more effectively in a challenging housing market.”

Wells Fargo faces a new class action lawsuit in California, accused of improperly charging undisclosed float fees to mortgage borrowers for over a decade.

Plaintiff Lance Baird claims he received a $3,000 check from the bank in 2022, with over $2,000 marked as a refund for a float fee he never agreed to. The lawsuit alleges Wells Fargo failed to explain how the charges happened or how refunds were calculated, forcing consumers to determine their own damages.

The complaint calls the bank's outreach a "throw-away effort" to limit liability. The suit seeks class certification, representing over 100 members with potential damages exceeding $5 million.

☀️ You’re all caught up. See you on Wednesday!

🚀 Wanna help our newsletter grow? Forward it to a friend or colleague.

Would you like to receive a ready-to-send weekly marketing email for your realtors and/or clients? Start your 30-day free trial here.

Was this email forwarded to you? Subscribe here.

Interested in advertising to 40k+ loan officers? Get in touch.