- Mortgage Nuggets

- Posts

- FHA mortgage demand rises

FHA mortgage demand rises

Plus: House approves new housing bill

🚼 Wednesday, the week's middle child, has arrived. Today’s newsletter is 677 words, a 2.5-minute read. Let’s get started…

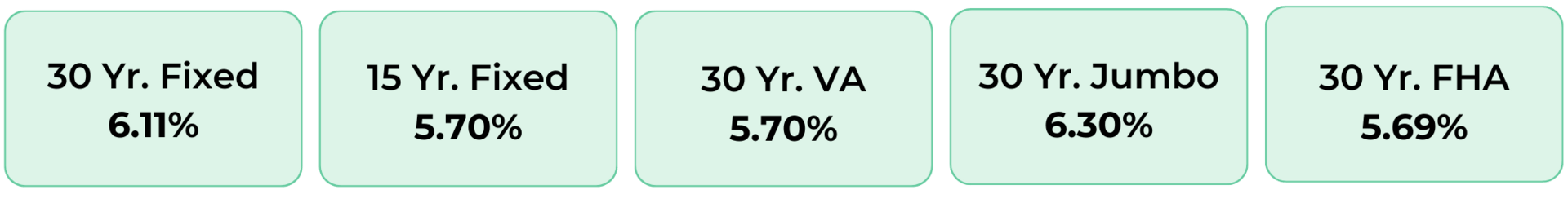

Disclaimer: Average mortgage rates as of February 10, 2026. © MND Daily Rate Index.

1. FHA mortgage demand rises

Mortgage rates for conventional loans didn’t budge last week, and neither did overall demand, but borrowers are actively seeking other loan products that offer bigger savings. Total mortgage application volume increased 0.3% last week.

Applications to refinance a home loan rose 1% for the week

Applications for a mortgage to purchase a home fell 2% for the week

The average interest rate for 30-year fixed-rate mortgages remained unchanged at 6.21%

“FHA purchase and refinance applications increased, helped partially by the FHA rate declining and remaining 20 basis points lower than the conforming 30-year fixed rate,” said Joel Kan, MBA’s vice president. “Borrowers are increasingly utilizing FHA loans as affordability challenges remain.”

2. House approves new housing bill

The Housing for the 21st Century Act (H.R. 6644) passed the House Financial Services Committee with strong bipartisan support and is now heading to the House floor.

Led by Chair French Hill (R-AR) and Ranking Member Maxine Waters (D-CA), the bill tackles the housing shortage and affordability crisis through several key changes:

Speeds up construction by cutting federal red tape and creating pre-approved building designs

Updates FHA loan limits to match current construction costs

Reforms local housing programs to better serve middle-income families

Expands financing options for manufactured homes and small mortgages

Protects veterans by excluding disability benefits from housing assistance income calculations

Reduces regulatory burdens on community banks

The Mortgage Bankers Association backed the bill, noting it aligns with similar Senate legislation. Industry groups praised the bipartisan effort to remove barriers to building more homes.

Marketing shouldn't be your second job

Stop juggling disconnected tools and start closing deals. Araya from Cotality gives brokers intelligent data solutions for smarter prospecting, borrower engagement, and client retention - powered by the industry’s gold standard property data.

Modern brokers need modern technology that’s built for them. Find high-intent borrowers, close more deals, and stay top of mind beyond closing. Schedule a demo today to see how we can help.

3. More Nuggets

📉 Lowest mortgage rates in more than 3 weeks. (Mortgage News Daily)

🏈 Inside this year’s real estate Super Bowl ads. (BAM)

😬 Survey: 94% of buyers will delay or downsize if mortgage rates don’t fall. (Clever)

🏗️ High mortgage rates remain the top concern for home builders. (NAHB)

📰 ION: "Hate brings views": Confessions of a London fake news TikToker. (LC)

4. Markets seeing the sharpest home price declines

In December 2025, home prices rose just 0.9% year over year, one of the softest growth rates since the post–Great Recession recovery, according to Cotality.

While prices are still rising nationally, many local markets are already in decline, with the South and West bearing the brunt of the correction.

Here are the top 5 metros and states seeing the steepest declines in home prices:

Metros

| States

|

5. Homeownership rate grows to 65.7%

According to new Census data, the U.S. homeownership rate rose to 65.7% in Q4 of 2025. While this marks a positive increase from the previous quarter’s rate of 65.3%, it remains below the 25-year average of 66.3%.

Meanwhile, the rental vacancy rate climbed to 7.2% in Q4 2025, up from 7.1% in the prior quarter and 6.9% a year earlier.

By age group, homeownership increased in only two segments: those under 35, rising to 37.9%, and adults ages 55–64, increasing to 76.7%. The largest decline occurred among homeowners ages 45–54, with the rate falling from 71.0% to 69.5%.

☀️ You’re all caught up. See you on Friday!

🚀 Wanna help our newsletter grow? Forward it to a friend or colleague.

Would you like to receive a ready-to-send weekly marketing email for your realtors and/or clients? Start your 30-day free trial here.

Was this email forwarded to you? Subscribe here.

Interested in advertising to 40k+ loan officers? Get in touch.