- Mortgage Nuggets

- Posts

- Existing-home sales rose to eight-month high in October

Existing-home sales rose to eight-month high in October

Plus: FICO and Plaid partner on updated UltraFICO Score

🎉 Friday is here! Today’s newsletter is 687 words, a 2.5-minute read. Let’s dive in…

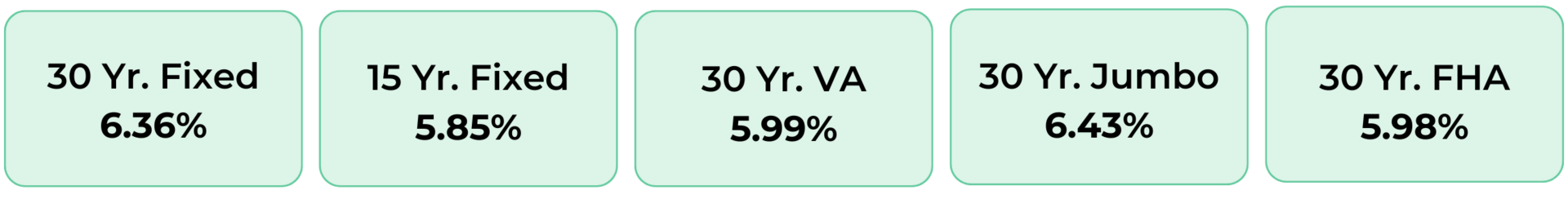

Disclaimer: Average mortgage rates as of November 20, 2025. © MND Daily Rate Index.

1. Existing-home sales rose to eight-month high in October

Sales of previously owned homes in October rose 1.2% from September to 4.1 million units on a seasonally adjusted, annualized basis, according to the National Association of Realtors. Sales were up 1.7% year over year. This count is based on home closings, so contracts likely signed in August and September.

Regional splits were uneven: the Midwest posted a 5.3% jump; the South rose 0.5%; the Northeast was flat; the West slipped 1.3%. First-time buyers made up 32% of sales, slightly higher than the prior month.

“Looking ahead, home shoppers in today’s market face some advantages from falling mortgage rates and seasonally slower competition,” said Danielle Hale, chief economist at Realtor’com. “At the same time, a lack of housing affordability continues to be a challenge keeping home sales in their historically low level.”

2. FICO and Plaid partner on updated UltraFICO Score

FICO and Plaid released a redesigned UltraFICO Score that embeds live cash-flow data into the credit evaluation process. The model blends FICO’s existing scoring architecture with consumer-permissioned account information sourced through Plaid’s network of more than 12,000 financial institutions.

Lenders gain visibility into deposits, withdrawals, and account balances across checking, savings, and money-market accounts, giving them a direct read on liquidity and spending patterns rather than relying solely on historical credit files.

The companies position the update as a way to sharpen risk assessment, widen credit access for borrowers with strong cash-flow profiles, and compress onboarding timelines by reducing document-collection friction.

The Insurance Agency Purpose-Built for Mortgage

Insurance complications shouldn’t cost you closings. When borrowers struggle to find compliant coverage, timelines slip.

Covered delivers solutions tailored to mortgage organizations:

55+ top-rated carriers with strong difficult-market access - Coverage options even where insurance is hard to place

Out-of-the-box integrations with Blend, ICE Servicing Digital, and Blue Sage - Fast, clean implementation

End-to-end mortgage lifecycle support - From origination through servicing and refinance

We’re the specialty shop built around mortgage workflows, connected to the tech you already use, and focused on borrower success. When insurance becomes a bottleneck, partner with the agency purpose-built for mortgage lending.

3. More Nuggets

📊 Sellers outnumbering buyers by 37%. (Redfin)

🏚️ Housing market is still passing through a home insurance shock, Cotality's chief data officer says. (ResiClub)

🏦 Citi CFO Mark Mason to step down in March. (BankingDive)

💼 Fairway to offer mortgage payment rewards through Made Card alliance. (HW)

4. Affordability improves for fifth straight month

Homebuyer affordability strengthened for a fifth straight month in October. The MBA’s index showed the national median payment for purchase applicants slipping to $2,039, driven by lower rates, rising earnings, and slower home-price growth.

The PAPI reading dropped to 152.0, the lowest since early 2022, reflecting a 4.2% decline in typical payments and a 5.5% annual affordability boost from income gains.

Lower-tier borrowers saw median payments fall to $1,402. FHA applicants registered $1,789, while conventional borrowers dropped to $2,063. Idaho and Nevada remained the least affordable markets; Louisiana and Connecticut were among the most affordable.

5. Stuart Levenbach Nominated As CFPB Director

Trump tapped OMB official Stuart Levenbach to run the CFPB for five years. The nomination drops as the Bureau warns it is nearly out of cash, heightening the stakes around its mission and viability.

Levenbach, a science-heavy regulator and former NOAA chief of staff, was elevated at OMB earlier this year. Industry groups quickly endorsed him as a chance to narrow the CFPB’s mandate and rein in its approach.

The timing triggered immediate backlash. Sen. Elizabeth Warren called the move a tactic to keep acting director Russell Vought in place beyond his 210-day limit and accelerate the administration’s efforts to weaken the agency.

☀️ You’re all caught up. See you on Monday!

🚀 Wanna help our newsletter grow? Forward it to a friend or colleague.

Would you like to receive a ready-to-send weekly marketing email for your realtors and/or clients? Start your 30-day free trial here.

Was this email forwarded to you? Subscribe here.

Interested in advertising to 40k+ loan officers? Get in touch.