- Mortgage Nuggets

- Posts

- Compass asks court to block Zillow from enforcing its listing standards

Compass asks court to block Zillow from enforcing its listing standards

Plus: FHA rescinds 12 policies as part of deregulation push

👋 Good morning and welcome back! Today’s newsletter is 737 words, a 3-minute read. Let’s dive in…

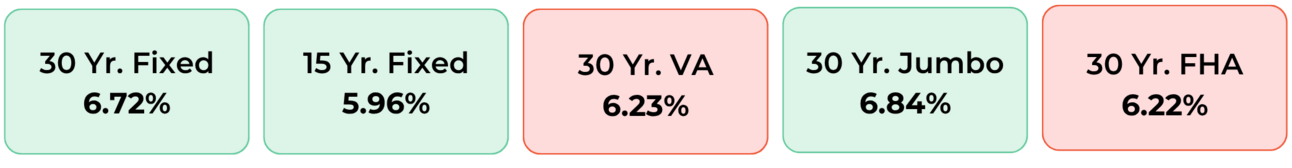

Disclaimer: Average mortgage rates as of June 27, 2025. © MND Daily Rate Index.

1. Compass asks court to block Zillow from enforcing its listing standards

Compass has filed for a preliminary injunction and expedited discovery to block Zillow’s new Listing Access Standards (LAS) from taking effect on June 30, 2025, citing irreparable harm to its business and clients.

This legal action escalates Compass’s earlier federal antitrust lawsuit filed on June 24, which accuses Zillow, Redfin, and eXp of coordinated anti-competitive behavior violating the Sherman Antitrust Act.

CEO Robert Reffkin alleges Zillow CFO Jeremy Hoffman offered to “double Compass’s market share” if Compass agreed to drop its marketing model. Reffkin also references pressure from Redfin CEO Glenn Kelman, who allegedly said it’s “not good when Zillow and Compass are warring.”

Zillow has called the lawsuit “unfounded” and maintains that listings “should be accessible to all buyers—across all platforms, including Zillow.” A judge ordered Zillow to respond by June 30, with a court hearing set for July 1.

2. Kamas mom accused of killing her husband charged with mortgage fraud, money laundering

The Kamas mother who is accused of killing her husband and writing a children’s book about grief is facing new charges involving the fraud that investigators believe led to the alleged homicide.

Kouri Darden Richins, 35, is facing 26 new felony charges, including five counts of mortgage fraud, five counts of forgery, seven counts of issuing a bad check, seven counts of money laundering, one count of communications fraud, and one count of a pattern of unlawful activity.

She had already been facing two counts of mortgage fraud, two counts of insurance fraud, and three counts of forgery as part of her murder case.

3, 2, 1 GO! Speed into efficient processing with wemlo® 🏎️ 🏁 Getting started with wemlo is as easy as 1-2-3.

This summer, leave slow processing in the dust. With wemlo, you get lightning-fast third-party processing that keeps your loans moving without the pit stops.

From submission to clear-to-close, our streamlined workflows and dedicated processing pods help you cross the finish line faster.

Our intuitive platform and experienced processors keep your files speeding through the pipeline—so you can focus on winning more business.

Book a wemlo demo today.

NMLS ID #1853218

3. More Nuggets

🚀 Michael Smith’s wild ride. How a former racer built a mortgage company from his hospital bed. (NMP)

💰 Here are the most expensive home sales of May. (Redfin)

🚨 Trump may name a ‘shadow’ Fed chair, an unprecedented development in American history. (CNN)

🏘️ DOGE layoffs are starting to leave their mark on D.C.’s housing market. (Yahoo)

4. GSEs prevented 60K foreclosures in Q1 2025

Fannie Mae and Freddie Mac helped to prevent 60,592 foreclosures through various actions in the first quarter of 2025. Since being placed under federal conservatorship in September 2008, they’ve completed more than 7.1 million foreclosure prevention actions.

Newly initiated forbearance plans dropped to 31,010 in Q1 2025 from 46,902 the previous quarter.

The number of loans in forbearance stood at 40,939, just 0.13% of the GSEs' serviced loans.

Florida had the most seriously delinquent loans at the end of March, followed by California and Texas. Foreclosure starts rose 4.9% to 21,972, and third-party/foreclosure sales increased 6.3%. LINK

5. FHA rescinds 12 policies as part of deregulation push

The Federal Housing Administration (FHA) announced on Friday that it is rescinding 12 policies tied to appraisal protocols, flood risk management, underwriter employment, and more. HUD Secretary Scott Turner called the changes “bold, necessary and long overdue.”

Key changes include eliminating appraisal steps deemed outdated, allowing part-time underwriters under specific conditions, and removing the requirement to submit the Supplemental Consumer Information Form (SCIF), which HUD said provided little value to borrowers.

HUD also dropped the mandate for pre-endorsement damage inspections in disaster areas, previously required even when no damage occurred. Instead, lenders can now use internal risk assessments. “The American Dream should never be buried under a pile of regulations,” Turner said.

☀️ You’re all caught up. See you on Wednesday!

🚀 Wanna help our newsletter grow? Forward it to a friend or colleague.

Would you like to receive a ready-to-send weekly marketing email for your realtors and/or clients? Start your 30-day free trial here.

Was this email forwarded to you? Subscribe here.

Interested in advertising to 40k+ loan officers? Get in touch.