- Mortgage Nuggets

- Posts

- Carrington to acquire Reliance First Capital

Carrington to acquire Reliance First Capital

Plus: Trade groups call for more MBS purchases by GSE’s to ease mortgage rates

🌞 Buongiorno. Let's get to it. Today’s newsletter is 612 words, a 2.5-minute read.

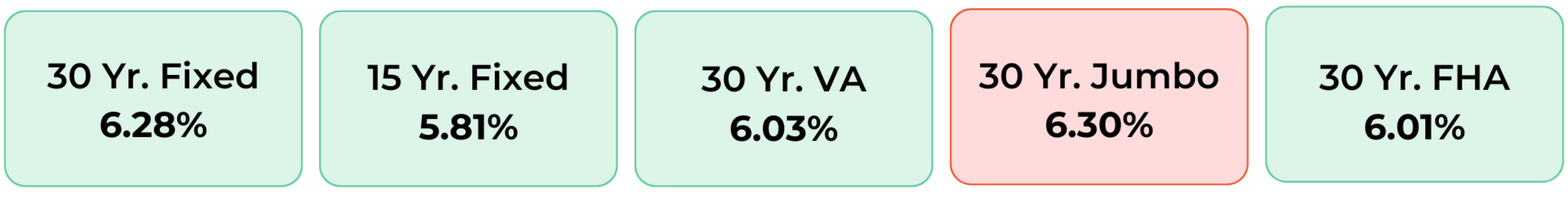

Disclaimer: Average mortgage rates as of October 31, 2025. © MND Daily Rate Index.

1. Carrington to acquire Reliance First Capital

Carrington Holding Company will acquire Reliance First Capital from Tiptree Inc., adding a direct-to-consumer mortgage channel to strengthen its retail, wholesale, and correspondent operations.

“This agreement makes our mortgage platform more balanced, competitive, and resilient,” said Carrington CEO Andrew Taffet. Reliance, founded in 2008 and based in Melville, N.Y., originates about $1 billion annually across FHA, VA, USDA, and Non-QM products, and services roughly $3 billion in loans.

Reliance CEO Hugh Miller said joining Carrington “will help us continue to grow and execute our mission to help homeowners achieve their financial goals.” The acquisition will also transfer Reliance’s 315 employees and proprietary origination platform to Carrington once the deal closes.

2. Robinhood, Sage Home Loans launch exclusive below-market mortgage offer

Robinhood and Sage Home Loans have partnered to offer Robinhood Gold subscribers mortgage rates at least 0.75 percentage points below the national average, plus a $500 credit toward closing costs on new purchases or refinances.

“This work reflects Sage’s commitment to leading the future of home lending,” said Sage CEO Mike Malloy. “Collaborating with Robinhood shows what’s possible when technology meets accessibility.” Malloy said the offer, first piloted over the summer, delivers “significant” value for Gold subscribers.

Robinhood’s Sakhi Gandhi said the partnership advances the platform’s goal of “democratizing finance” and expanding its financial services ecosystem. Sage remains the lender of record for all participating loans.

A MESSAGE FROM MINDSTREAM

Master ChatGPT for Work Success

ChatGPT is revolutionizing how we work, but most people barely scratch the surface. Subscribe to Mindstream for free and unlock 5 essential resources including templates, workflows, and expert strategies for 2025. Whether you're writing emails, analyzing data, or streamlining tasks, this bundle shows you exactly how to save hours every week.

3. More nuggets

📊 Rocket Companies' Q3 2025 earnings soar past expectations. (HousingWire)

📰 Compass provides long-awaited clarity on the Anywhere merger. (inman)

⚖️ Judge orders Trump administration to pay SNAP benefits with emergency funds. (The Hill)

💰 ION: The lucrative economics of expert witnesses. (theHustle)

🏦 After the Fed cut interest rates, adjustable-rate mortgages may be ‘an underappreciated opportunity,’ top advisor says. (CNBC)

4. Trade groups call for more MBS purchases by GSE’s to ease mortgage rates

Trade groups representing community banks and home lenders are urging the Trump administration to allow Fannie Mae and Freddie Mac to purchase mortgage-backed securities (MBS) to help bring down mortgage rates.

The idea relies on amending the Preferred Stock Purchase Agreements (PSPA) to enable the GSEs to purchase up to $300 billion of their own MBS and Ginnie Mae MBS when the spread between the 30-year mortgage rate and the 10-year Treasury exceeds 170 basis points.

The proposal was outlined in a letter sent by the Community Home Lenders of America (CHLA) and the Independent Community Bankers of America (ICBA) to the Treasury Secretary Scott Bessent and the Federal Housing Finance Agency (FHFA) Director Bill Pulte.

5. More than 40% of homeowners don’t have a mortgage

A record 40.3% of homeowners own their homes outright, up from 32.8% in 2010, reflecting a steady rise in mortgage-free ownership, according to ResiClub’s analysis via the NY Post.

Over half of the nation’s 35 million mortgage-free owners are 65 or older, and nearly two-thirds own their homes free and clear. Regions with older populations and lower home values (like Texas and parts of the South and Midwest) report the highest rates, while high-cost metros (like Denver and Washington D.C.) rank lowest.

Analysts expect the trend to fuel growth in equity-based products such as reverse mortgages, as more seniors seek to tap their home wealth without selling.

A MESSAGE FROM MONEY®

Get home insurance that protects what you need

Standard home insurance doesn’t cover everything—floods, earthquakes, or coverage for valuable items like jewelry and art often require separate policies or endorsements. Switching over to a more customizable policy ensures you’re paying for what you really need. Use Money’s home insurance tool to find the right coverage for you.

☀️ You’re all caught up. See you on Wednesday!

🚀 Wanna help our newsletter grow? Forward it to a friend or colleague.

Would you like to receive a ready-to-send weekly marketing email for your realtors and/or clients? Start your 30-day free trial here.

Was this email forwarded to you? Subscribe here.

Interested in advertising to 40k+ loan officers? Get in touch.