- Mortgage Nuggets

- Posts

- Bayview closes acquisition of Guild

Bayview closes acquisition of Guild

Plus: CFPB to shift remaining litigation to DOJ

🎄 Good Monday morning, and welcome to December! Let’s get into it…

Disclaimer: Average mortgage rates as of November 28, 2025. © MND Daily Rate Index.

1. Bayview closes acquisition of Guild

Bayview closed its purchase of Guild Holdings, taking Guild private at $20 per share and delisting it from the NYSE.

Guild keeps its leadership, brand, and operations, becoming an independent entity within Bayview’s mortgage-servicing ecosystem alongside Lakeview Loan Servicing.

The deal values Guild at about $1.3 billion and creates deeper vertical integration across origination and servicing. No operational changes are planned.

“Joining Bayview’s platform strengthens Guild’s commitment to grow our national brand, and it creates one of the strongest and most compelling mortgage origination and servicing ecosystems in the nation.” Guild CEO Terry Schmidt said in a press release.

2. Former local Realtor association CEO charged with grand theft

A former East Polk County Realtor association CEO, Jennifer Garula-Mers, was arrested and charged with grand theft after investigators concluded she stole more than $81,000 from the organization.

Detectives say she repeatedly raised her own salary without approval, issued unauthorized payroll checks and bonuses, filed improper reimbursements, made personal purchases on the association credit card, and boosted her retirement contributions.

The association discovered irregularities in 2024 and referred the case to law enforcement. She was terminated in August and is now facing charges in Polk County.

Two Loan Officers walk into a deal…

LO #1: Still waiting for underwriting to “get back to them.” Client is ghosting. Realtor is frustrated.

LO #2: Typed the scenario into Guideline Buddy. Got the answer in seconds. Called the client back. Deal saved. Realtor impressed.

One looks like a rookie. The other looks like a hero.

👉 Start using Guideline Buddy today — and always be the LO with the quick comeback.

P.S. Guideline Buddy is free right now. If you’re not using it, your competition is.

3. More Nuggets

📊 Average mortgage rate falls to 6.23%, ending a three-week climb. (AP)

⚖️ Rep. Swalwell sues FHFA’s Bill Pulte, alleging misuse of mortgage records. (Politico)

🆕 Kevin Hassett is the rumored lead for Fed chair position. (Reuters)

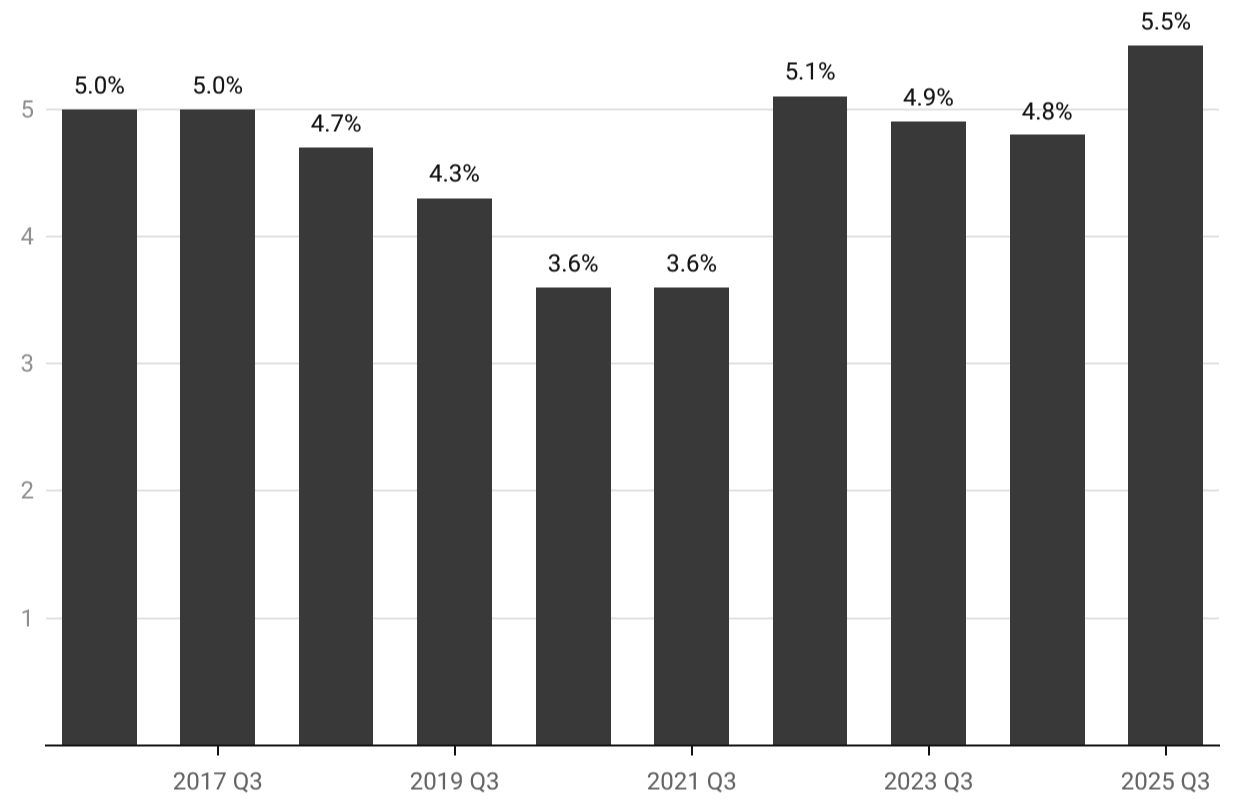

4. Charted: Delistings tick up to a decade high

While national active inventory is still up year-over-year, the pace of growth has slowed since summer as some home sellers have thrown in the towel and delisted their properties. Indeed, according to Redfin, U.S. delistings as a share of inventory recently ticked up to 5.5%—a decade-high reading for this time of year.

In housing, a delisting is when a home that was listed for sale is removed from the market before it sells.

5. CFPB to shift remaining litigation to DOJ

The Consumer Financial Protection Bureau (CFPB) will hand off its remaining enforcement lawsuits and other active litigation to the U.S. Department of Justice (DOJ) as the Bureau prepares for a potential funding lapse.

CFPB enforcement investigations had largely halted since acting Director Russell Vought took over leadership of the agency in February.

Staff were informed that DOJ will begin assuming matters from the CFPB’s enforcement and legal divisions in the coming weeks, with transfer logistics to be worked out. It remains unclear whether all pending cases will survive the transition or whether case schedules and continuity will be affected.

☀️ You’re all caught up. See you on Wednesday!

🚀 Wanna help our newsletter grow? Forward it to a friend or colleague.

Would you like to receive a ready-to-send weekly marketing email for your realtors and/or clients? Start your 30-day free trial here.

Was this email forwarded to you? Subscribe here.

Interested in advertising to 40k+ loan officers? Get in touch.